The COVID-19 pandemic has disrupted growth and people's livelihoods and the negative impact on M&A markets is obvious, both in CEE and globally. However, there are critical downstream effects to consider, as well as longstanding challenges that existed prior to the pandemic, that investors must keep in mind and mitigate where possible.

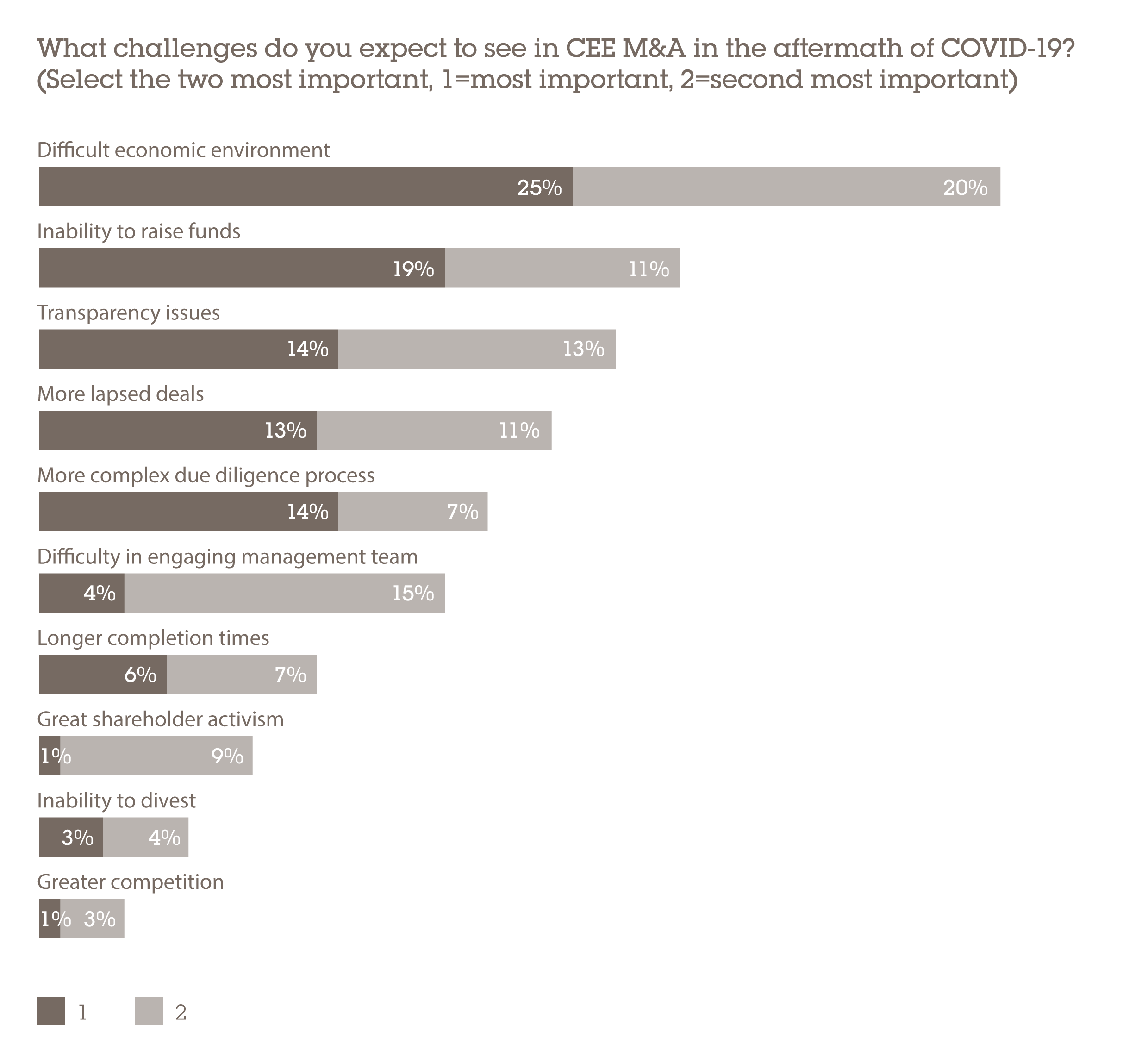

In the aftermath of COVID-19, it is growth and the ability – or inability – to raise financing that are keeping investors up at night. A quarter of respondents said that a difficult economic environment is the most important challenge for the region's dealmaking market and 45% put this among their top two challenges.

Uncertainty continues to loom over prospects in 2021. It is widely expected that economies will rebound strongly, however this will hang on the efficiency and success of vaccine rollouts versus the potential for higher rates of contagion in light of emergent strains of the virus. The need for lockdowns to contain the spread ahead of inoculation reaching critical mass has the potential to cause further interruptions to both economic and M&A activity.

The right funding for the right deal only

One of the most striking deal-specific impacts of recent conditions is the behaviour of banks, which are assessing the quality of their loan books and being more selective in the sectors and assets to which they will provide senior financing. Debt is available for the right transaction, however lenders may not share the same opinion on the quality of businesses given the volatility of earnings. This appears to be fostering some anxiety: the inability to raise funds was cited by 19% of respondents as the top challenge to M&A and by 30% as one of their two biggest dealmaking hurdles.

However, a nascent private debt market is emerging in CEE and the conditions are ripe for explosive growth. “Banks are eager to finance transactions, but we also see debt funds that are providing acquisition financing for deals that the banks are not willing to support. This is a new and very interesting development in the Polish market,” says Przemyslaw Kozdoj, partner in Wolf Theiss's Warsaw practice.

One such name is Kartesia, a pan-European private debt manager that recently received investment from Candriam and its affiliate New York Life Investments Alternatives. Kartesia has been highly active in recent years and in November 2020 closed its first ever deal in Poland. The firm invested €32m in Nu-Med Group, a healthcare company owned by Enterprise Investors, one of the largest private equity firms in CEE, allowing it to refinance its existing bank liabilities.

“Traditionally, we had a huge gap between the price of bank financing and fund financing. I see that gap is being breached point by point. I expect that credit funds will be far more active in the next year or two in terms of financing M&A activity, especially in Poland. This will be a very important shift in the market situation,” adds Kozdoj .

COVID hits the deal process

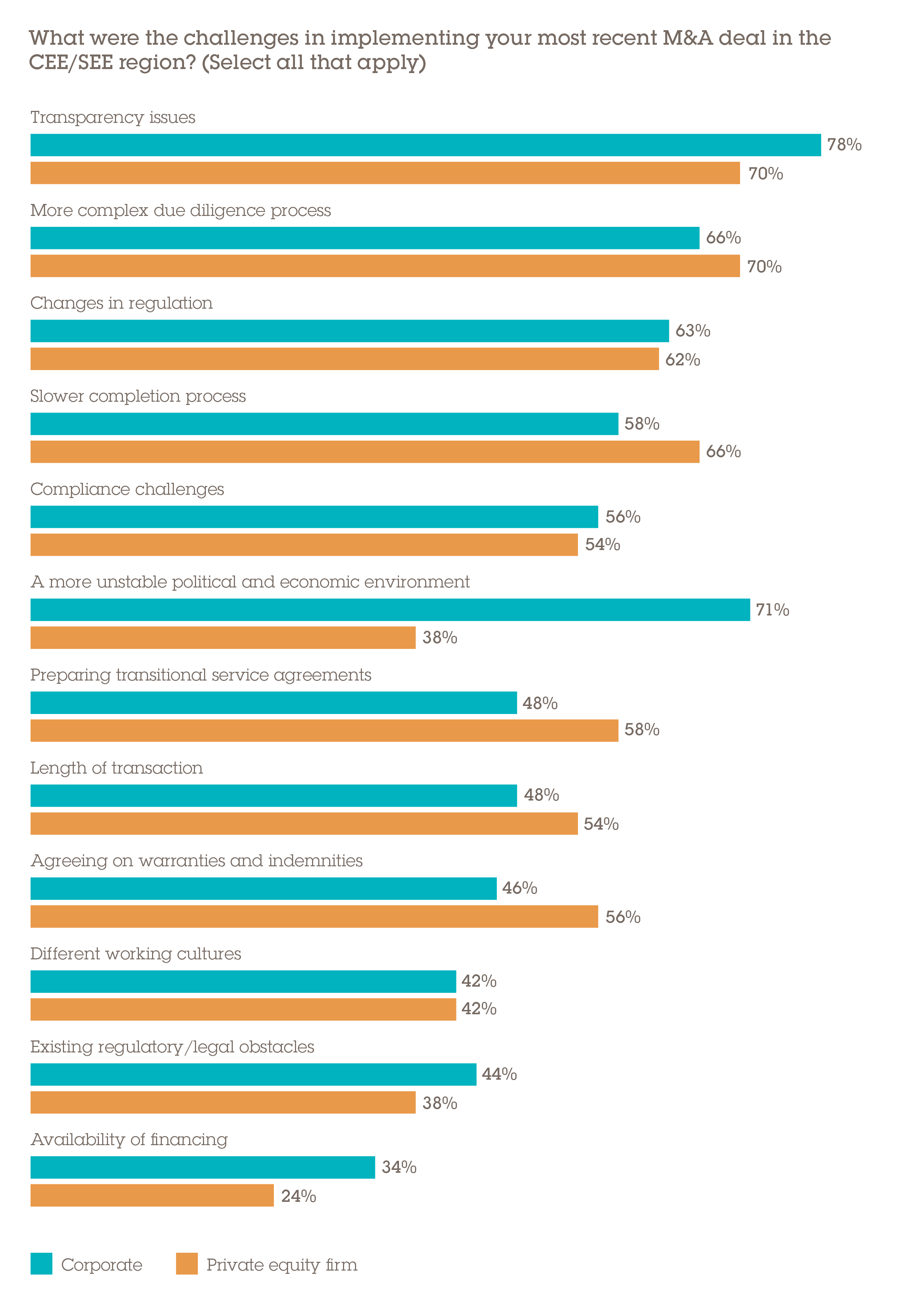

Regarding challenges in implementing their most recent deals, 75% of respondents pointed to transparency issues, 61% cited slower completion processes and 67% highlighted more complex due diligence. All three of these are closely related and are direct consequences of limitations imposed by the pandemic, but are by no means exclusive to CEE deals. Companies' attention and operational bandwidth has been consumed as they navigate the pandemic, making diligence requests and timelines more challenging. This can also raise concerns among investors regarding transparency, further complicated by what can be dramatic changes to earnings forecasts and therefore what constitutes fair representation and value.

Social distancing measures have also made it inherently more challenging to meet with senior management teams, making diligence a wholly virtual process. “What we now see is an increasing virtualisation of transactions and long-distance due diligence. You have all the negotiations, the dealmaking taking place in the virtual room,” says Tomasz Stasiak, a partner in Wolf Theiss's Warsaw office. “For real estate deals, investors require on-site inspections because they need to have a look and feel of things. New technologies such as 3D virtual reality applications will make it possible to really inspect and visit real estate without being there.”

While PE and corporates faced many similar obstacles in their most recent deals, there is one key difference – 71% of strategics felt a more unstable political environment was a challenge compared with only 38% of PE fund managers who agreed. As discussed in 'Strategics vs sponsors: the great divide', the vagaries of policymaking tend to have greater consequences for strategics than PE as the latter can invest across the industry spectrum, a luxury not available to corporates.

There are examples of contentious political moves that have hurt businesses' top lines. In 2020, the Hungarian government imposed a special tax for large retailers, a reintroduction of a levy brought in in the early 2010s, although at the time it was applied across retail, banking, energy and communications. These special taxes drew criticism and international legal challenges. The European Union was initially successful in annulling a retail tax on revenues in both Hungary and Poland, only for the countries to win a subsequent EU court case.

Notably, the two countries have also shown the strongest opposition to the EU of any member states in CEE/SEE, both resisting its membership conditions. “The unstable economic and political environment increases the number of risks for us,” says the head of strategy of a Swiss multinational. “When selecting targets, we will be reviewing the recent impact of political decisions and economic changes.”

Future hurdles

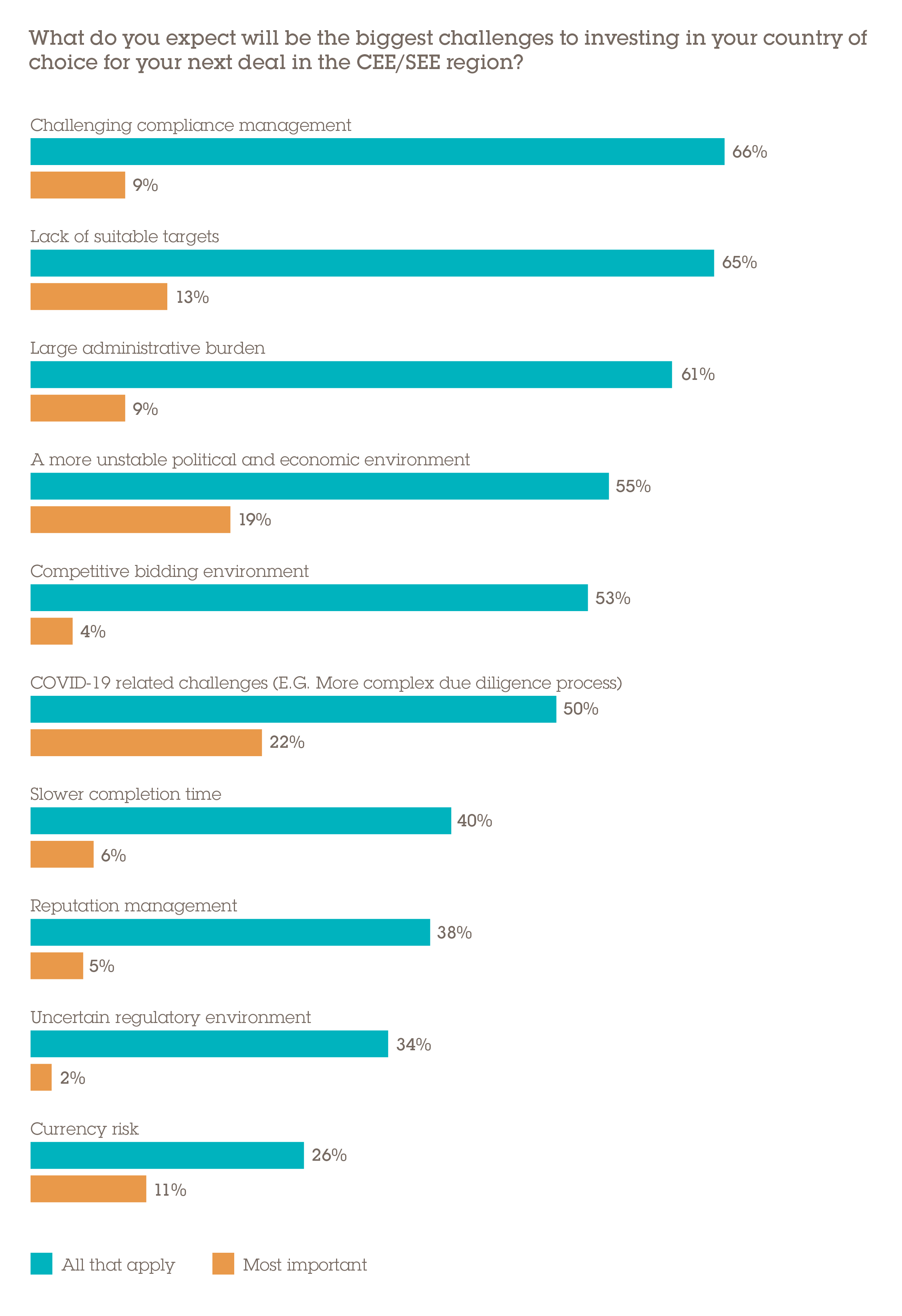

The biggest challenges to investors' forthcoming deals in the region are fairly evenly split, with compliance management and a lack of suitable deals standing out for 66% and 65% of respondents, respectively. The availability of compelling investment opportunities can also be a challenge in certain markets. Despite being two of the first countries to liberalise their economies in the post-communist era, deal opportunities in both the Czech Republic and Hungary can be somewhat limited. In addition, under the current administration there has been a considerable degree of state intervention in Hungary's M&A market, which can distort competitive dynamics and make it more challenging for investors to successfully secure deals.

“Some deals are driven by state-owned fund acquisitions or investors that are close to the local market,” says Janos Toth, a partner in Wolf Theiss' Budapest office. “That is a very particular feature in the Hungarian market, and it can be a handicap for foreign investors, depending on the target sector.”

However, the strength of the deal pipeline is not the single biggest challenge in the minds of investors. That would be COVID-19 and related issues, cited by 22% of respondents. No doubt this will be the case for some time to come. Even when the pandemic comes under greater control, it will leave a lasting impression on the structure of economies and the nature of M&A activity, not only in CEE but worldwide.