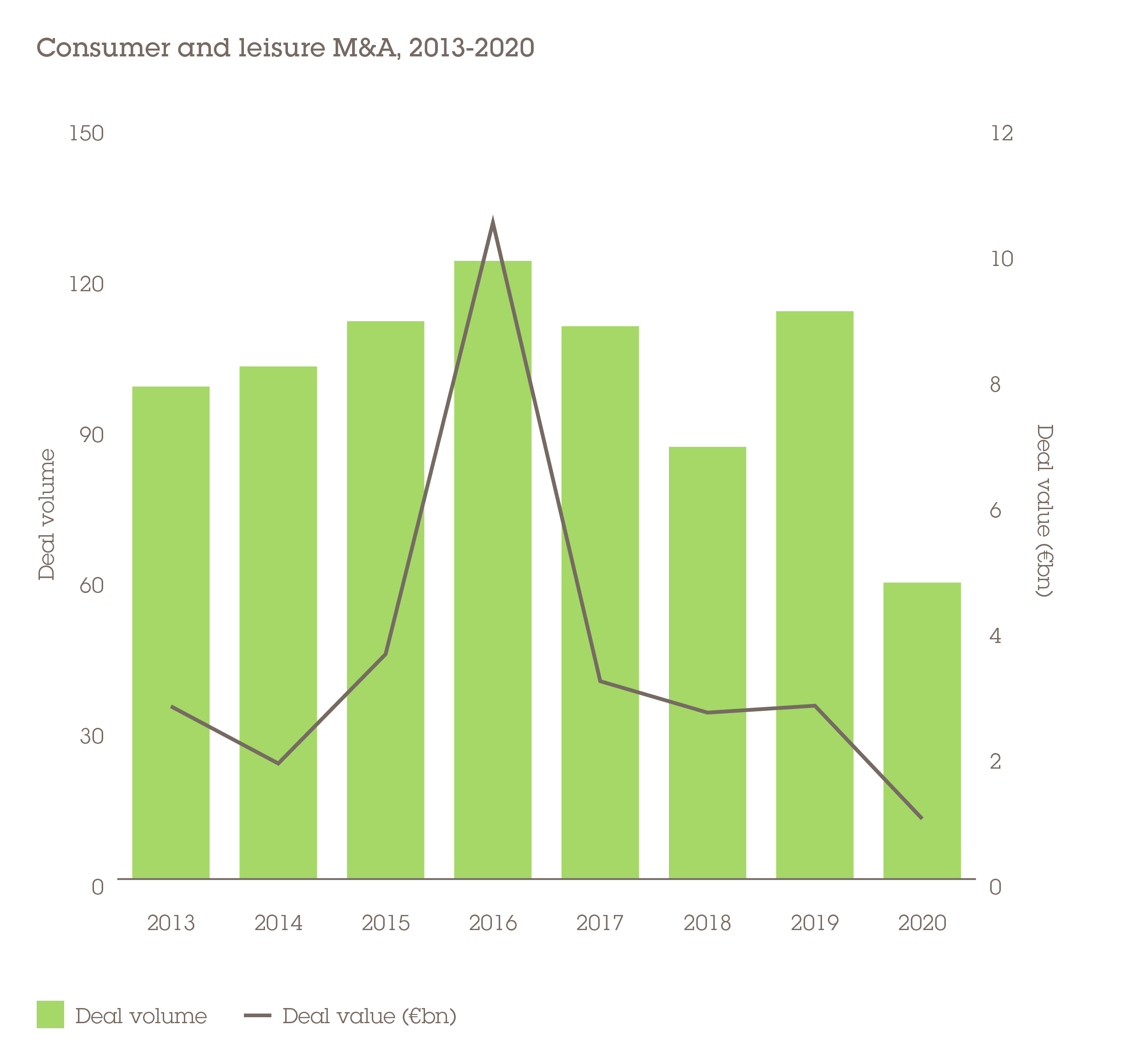

No other sector was hit as badly as consumer and leisure in 2020, dramatic falls in activity being registered across both deal value and volume. A total of €962m was invested across 59 deals, representing declines of 65% and 48% respectively. The scarcity of investment mirrors the industry's fortunes globally in 2020, with consumers only buying necessary items and holding off on big ticket purchases, and leisure and hospitality being especially prone to lockdown measures. Hotels that have closed for business will not reopen in some cases and suppliers of these industries are reeling from the effects of the pandemic.

Those transactions that did go ahead, once the full scale of the coronavirus outbreak was understood, were notable for their defensive characteristics. The largest, lottery operator Sazka – in which Apollo Global acquired a minority stake for €500m – makes its revenues from low-cost purchases that are likely to remain attractive to Czech consumers even through hard times.

Danish Salling Group's takeover of Tesco Polska for €202m, the sector's second-largest deal, is a good example of capturing non-discretionary spend. Supermarkets have been clear winners during the pandemic, with their primary concern being maintaining the integrity of their supply chains rather than a lack of demand. That said, a strong e-commerce and home delivery proposition is now more critical than ever before for food retailers.

Big countries dominate sector M&A

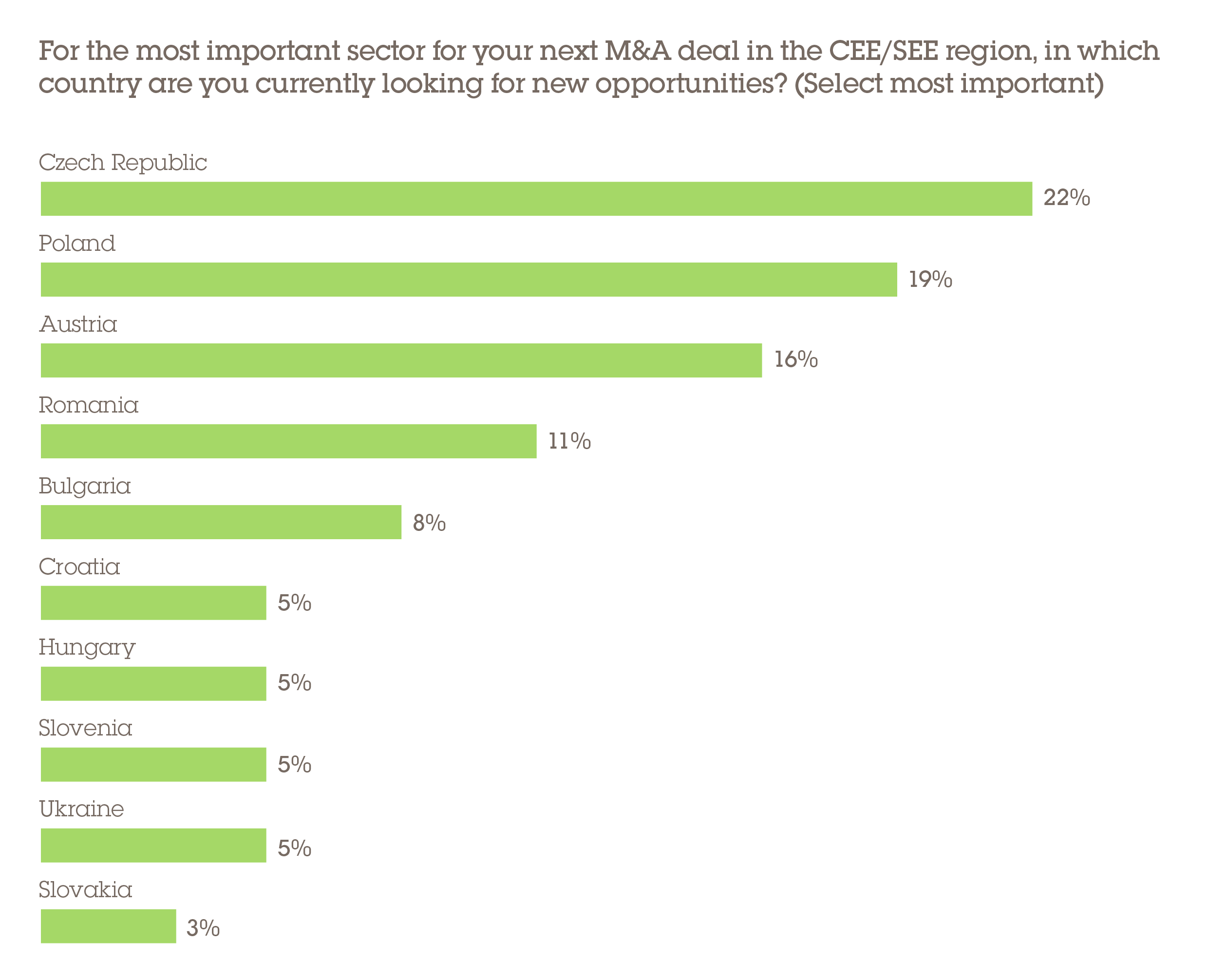

Given that these two largest deals in the Czech Republic and Poland combined were worth €702m and the sector only saw €962m in activity, these two countries clearly dominated. Indeed, these are also the countries that respondents continue to look at as gateway locations for their next opportunity in the consumer and leisure sector with Czech Republic first (22%) and Poland second (19%).

Both countries have compelling features. Poland is the region's largest economy and has showed robust growth for many years now, including withstanding the effects of the pandemic from an output standpoint. Its population of 37.8 million also means it has a large consumer base. The Czech Republic has the second highest GDP per capita in the CEE region at US$24,254, giving the population strong purchasing power. The country has also demonstrated success in the consumer sector, with companies like the food delivery unicorn Rohlik benefitting from lockdowns. The start-up had expanded into Hungary, Austria, and Romania before 2020 and now has its sights on Germany.

Distressed and defensive deals drive M&A

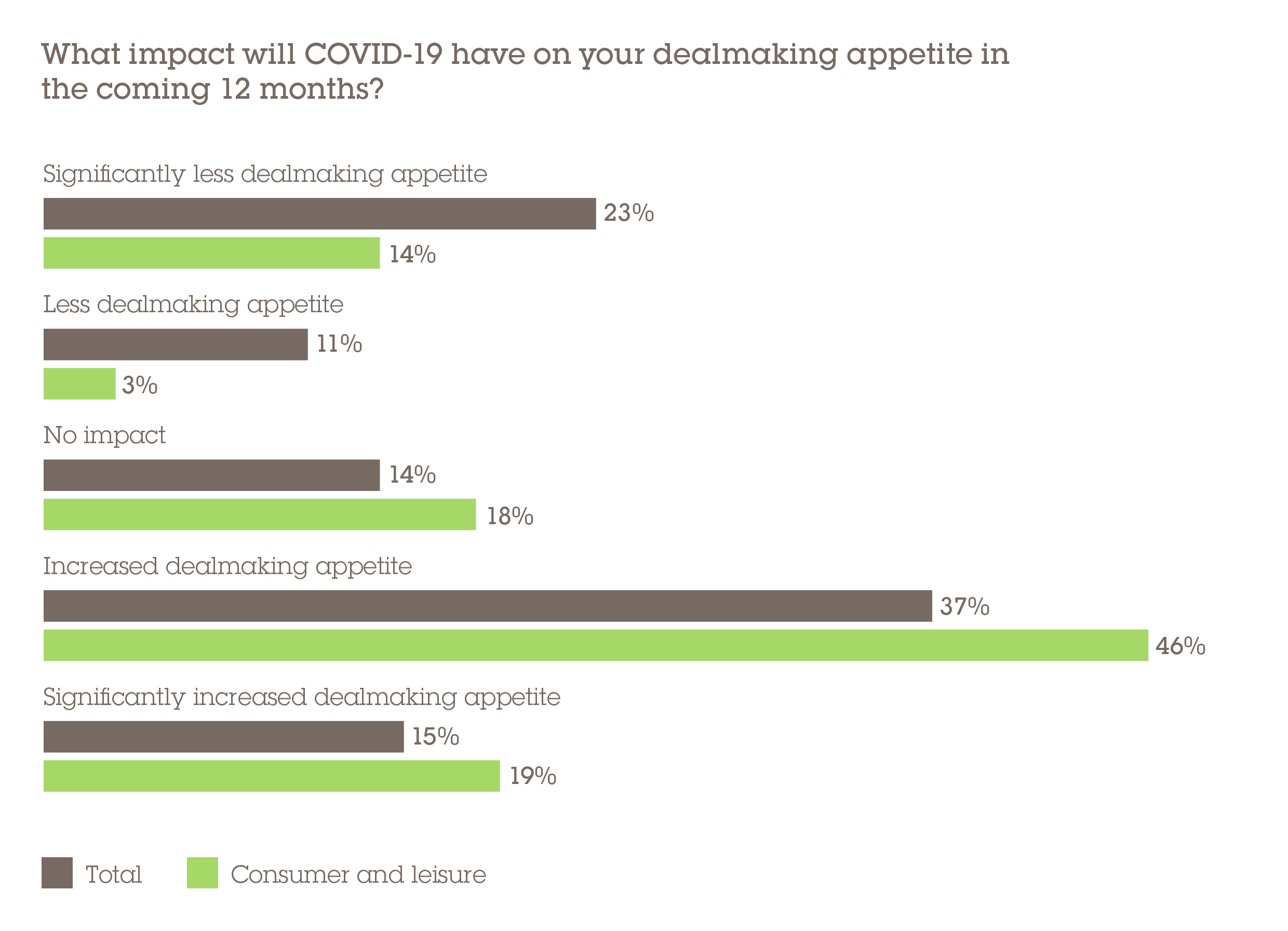

Nearly two-thirds (65%) of respondents believe COVID-19 will increase dealmaking appetite in the sector, with 19% believing this appetite will significantly increase. There is good reason to expect a recovery in deal activity. For one, many assets in the sector have been operating through a prolonged period of financial distress and some will have no option but to seek financing to bolster their balance sheets. Hotels and travel companies in particular have been feeling the pain of restrictions on movement. Loan moratoriums and stimulus can only keep these more exposed segments of the economy afloat temporarily.

Outside of distressed deal flow, however, defensive companies continue to change hands. Poland's Velvet Care – manufacturer of recognised brands Velvet, Kleenex and Huggies – acquired its Czech counterpart Moracell for €16m. Although the deal was made in January, prior to COVID-19 being recognised as a global pandemic, if there is one item that consumers continue to buy regardless of the economic outlook, it is toilet paper. There is also a wellbeing angle that is driving demand and is likely to underpin future deals, a trend that was in motion before the pandemic had populations paying closer attention to their health.

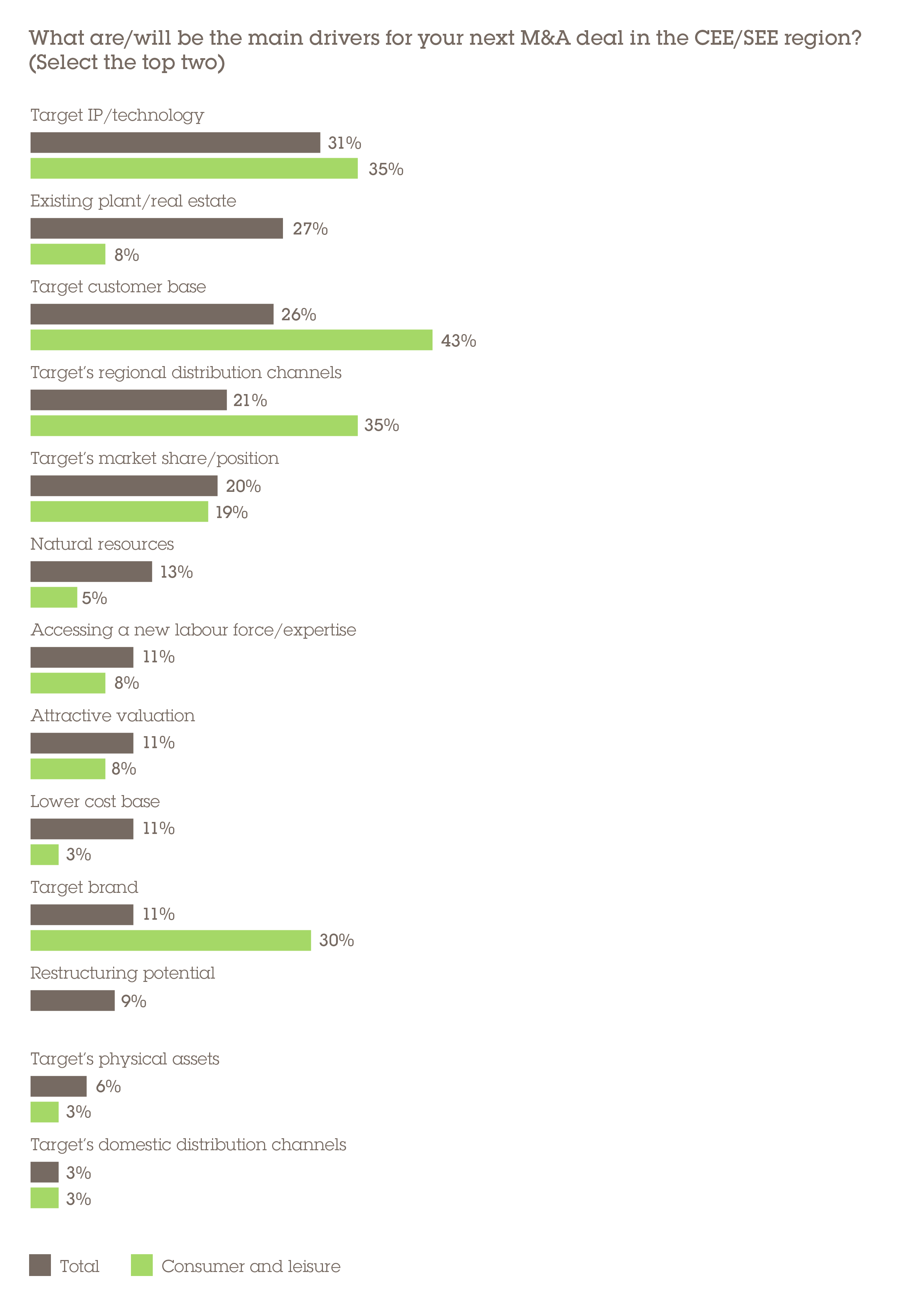

When it comes to specific factors behind deals, our research shows that 43% of respondents point to acquiring the target's customer base as the main attraction, followed by 35% who view the company's regional distribution as a top deal driver. Accessing these assets can generate significant value, especially in cross-border deals. Acquiring a peer in a neighbouring country can allow a consumer company to simply introduce their existing brand to new customers and reach wholesalers through an established logistics network, which requires relatively little heavy lifting.

A further 35% of respondents singled out acquiring a target company's IP or technology as being a primary deal motivator. Specifically, these tech-related assets are likely to be e-commerce related as consumer businesses have been forced to recognise the value of digitisation and reaching customers remotely via the internet.

Core focus and capital need drive consumer sector

The pandemic has hit consumer spending, especially for products at the discretionary end of the spectrum. But with CEE weathering the crisis better than Western European economies, some consumer companies face relatively better prospects in their home region. Core markets are likely to be a key focus in the next 12 to 24 months, which could result in Western European retailers jettisoning CEE chains, creating opportunities for opportunistic consolidation.

Meanwhile, leisure continues to represent a distressed opportunity, with assets in need of capital under pressure to survive. Many consumer goods businesses will face similar financial headwinds, but there are plenty of pockets of growth and companies who are not only surviving but thriving amid the health crisis. Businesses with the foresight to develop strong digital offerings and which have been able to reach the homebound consumer will be in high demand.