The COVID-19 pandemic rattled M&A markets worldwide and will likely shape activity for some time to come. While CEE/SEE has outperformed other regions, it’s worth noting that the 29% increase in deal value also came with a 22% fall in deal numbers.

The events of 2020 have given investors pause for thought and forced them to reassess the economy and how they can best achieve a return on their capital after the year in which everything changed.

The downturn in deals – which arguably gives a truer picture of market sentiment than value, as the latter can be inflated by a handful of large acquisitions – could be a function of a number of factors. Uncertainty has played a crucial role, especially during lockdown periods. But even with the strongest will to pursue deals, the current crisis poses challenges. For instance, delays in closing transactions may arise if regulatory approval needs to be obtained where regulatory bodies are coping with operational disruption and backlogs. There is also potential for the ebbing and flowing pandemic to trigger material adverse change (MAC) clauses in deal contracts or disagreements over whether fair disclosures have been provided by sellers. Then there is the question of how to determine the fair value of assets amid so much earnings volatility.

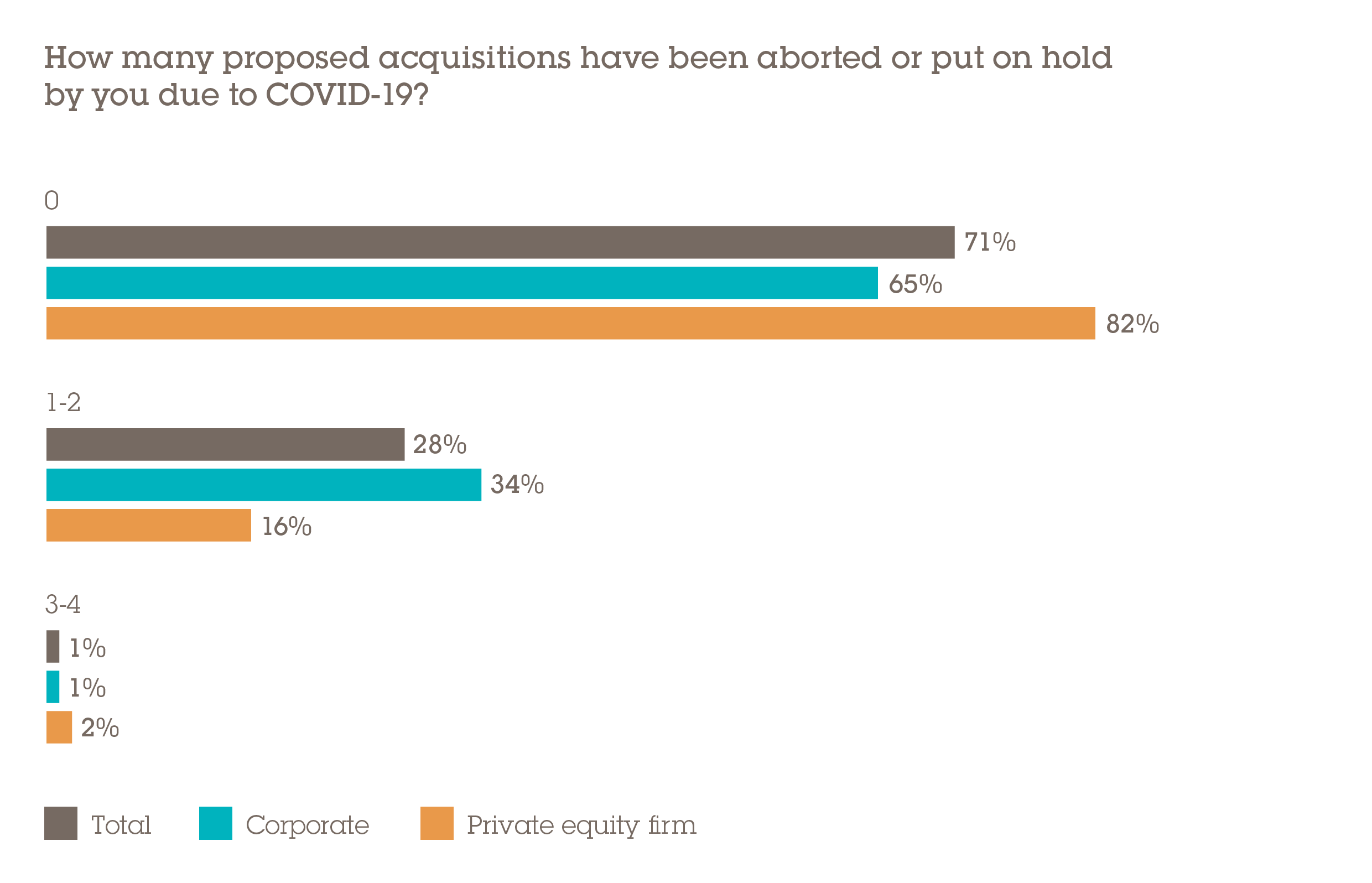

For the most part, investors have found that deal processes have gone unaffected by the pandemic, but there is a significant minority who say otherwise. Our research shows that 71% of respondents have not had to abort or delay acquisitions, but a sizable 29% have.

The post-COVID outlook

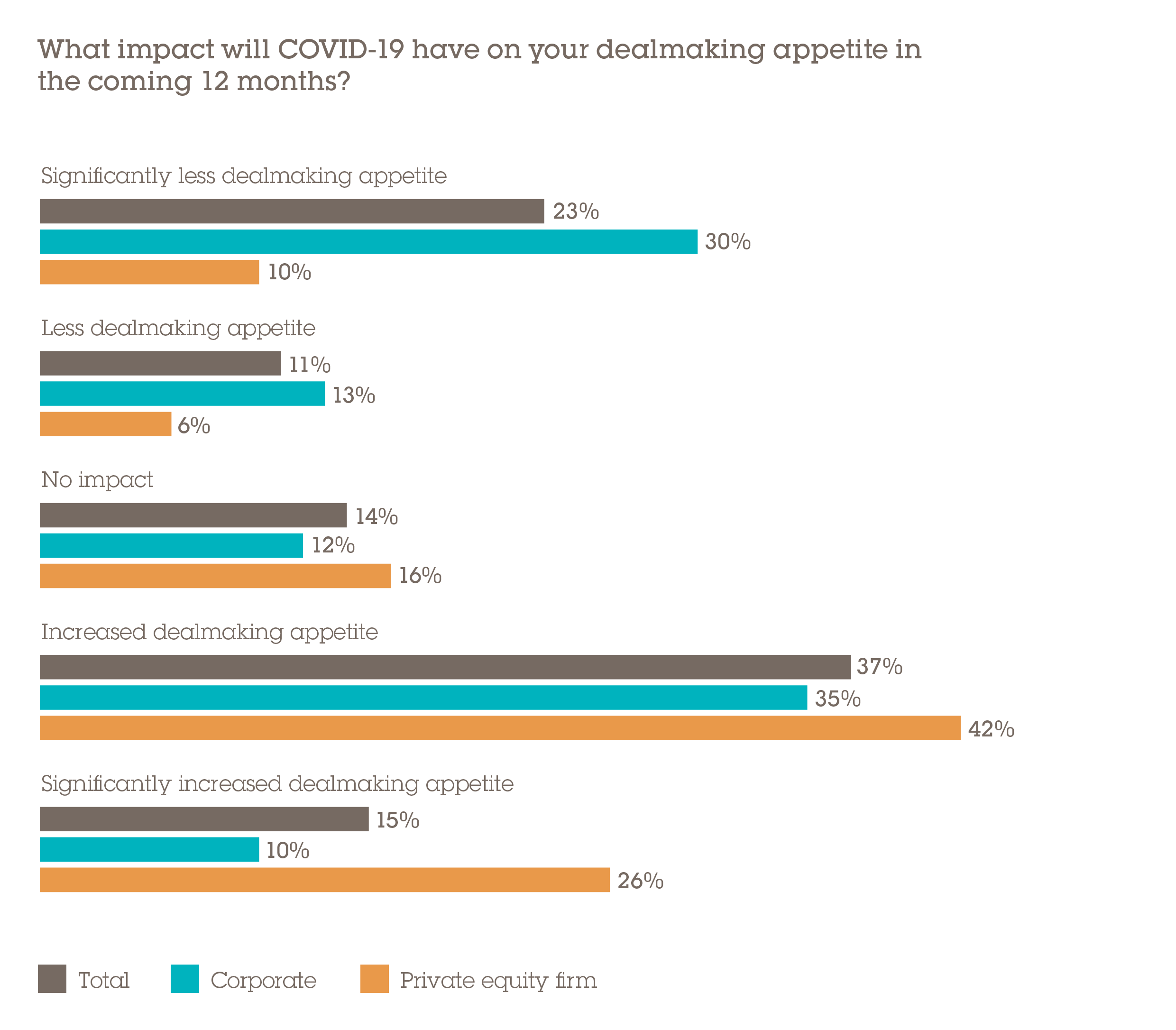

When it comes to future activity, our survey reveals that the majority of dealmakers are somewhat upbeat – however, there are still a large proportion that don’t see the market rebounding in 2021. Just over half (52%) of respondents feel that the health crisis will increase appetite for dealmaking in the next 12 months, with 34% anticipating a decrease and the remaining 14% expecting little change in 2021.

“We are assessing risks more closely, and it is important to remain proactive in this situation. With COVID-19 and the possibility of further waves, we are ensuring that we evaluate opportunities closely,” says the head of M&A of an Italian multinational.

Tellingly, however, private equity investors are far more bullish than corporates. Whereas 43% of strategic buyers report having less appetite for deals, only 16% of PEs agree; meanwhile, just 10% of corporates are eager to pursue significantly more deals versus 26% of fund managers who said the same.

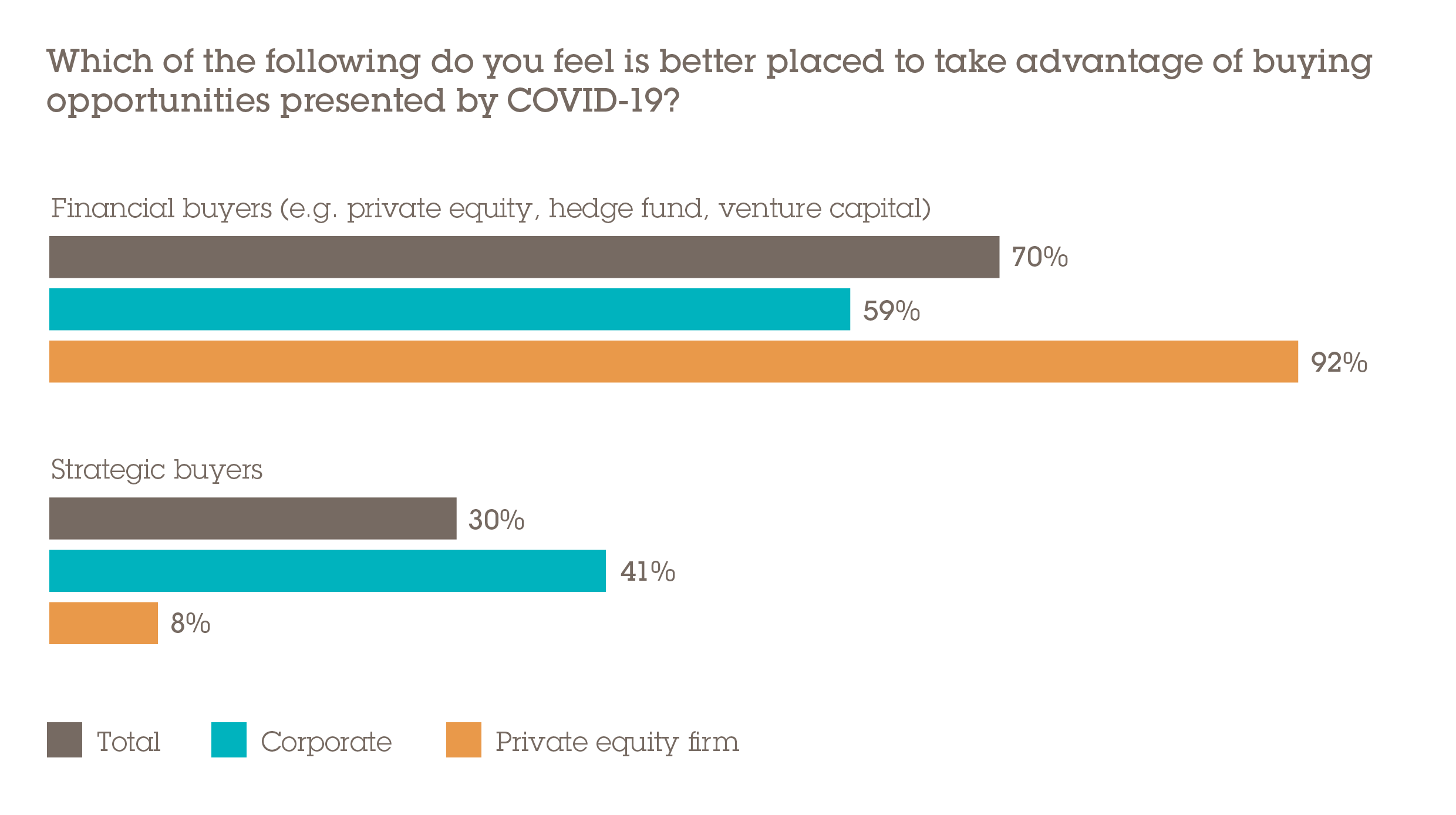

Further to this, we find that respondents believe that financial buyers are best placed to take advantage of the opportunities presented in the aftermath of COVID, with a 70% to 30% split in favour of PE over strategics. There are a number of reasons why PE may be more acquisitive over the short to medium term, which we explore in more depth here.

One factor is that current conditions are uniquely suited to PE funds' skill set and high-risk appetite. This puts PE at a significant advantage in what remains an unpredictable and highly challenging trading environment for many businesses.

“PE is in a strong position in part because of its attitude towards risk-taking in terms of participating in an upside cycle of the economy,” said Horst Ebhardt, a partner in Wolf Theiss' Vienna office. “As an asset class, it has also accumulated a significant amount of cash that it needs to deploy and now there are many different deployment strategies. PE can offer a wide range of fund vehicles, depending on the sector or the level of envisaged corporate control. For example, we now increasingly see major PE funds taking minority positions in fast-growing companies.”

Deals from disruption

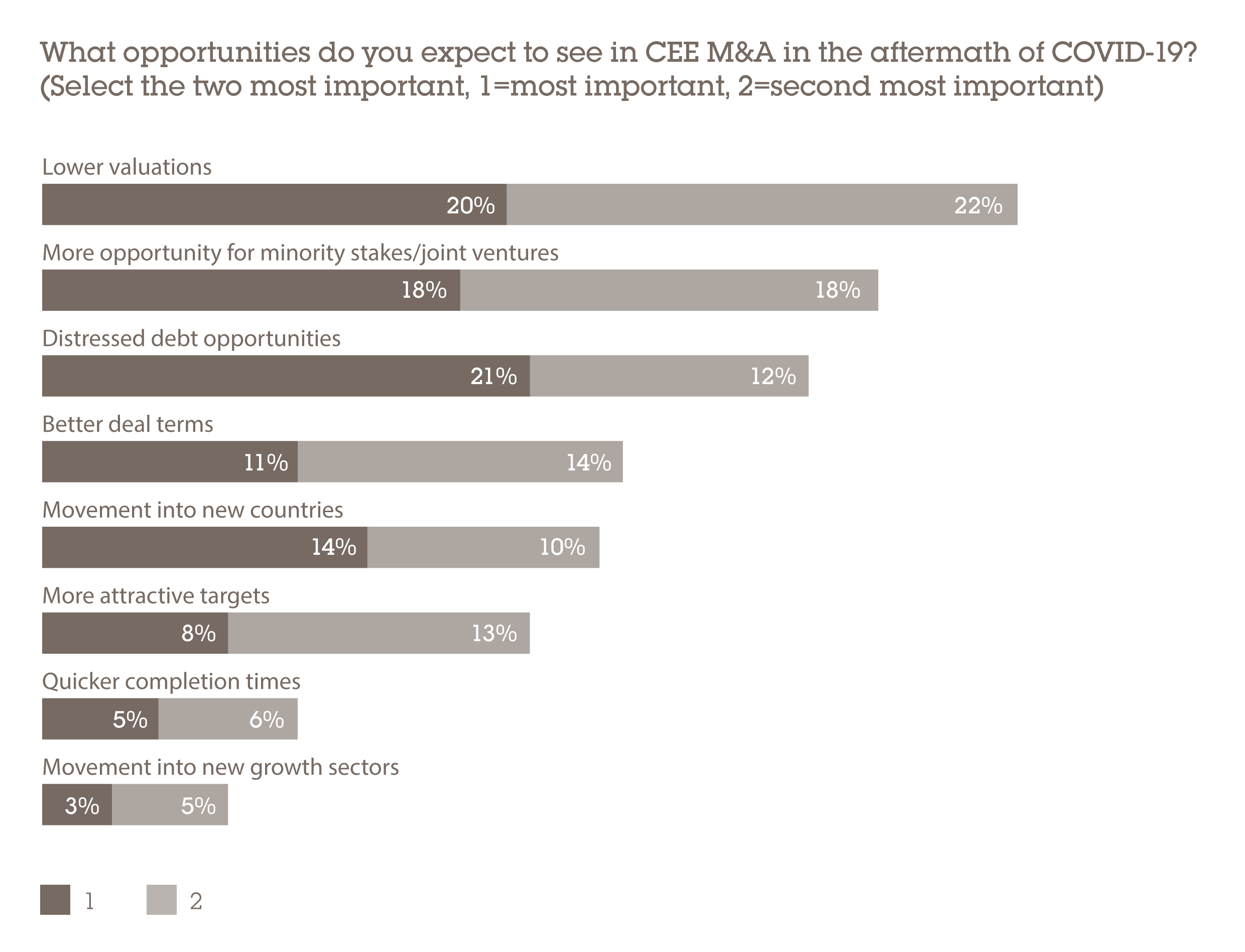

There will be ample opportunities to seize upon across CEE/SEE in the aftermath of COVID-19. Respondents tell us that the main benefits of the current disruption are lower valuations, cited by 42%, followed by more minority investments and joint ventures (36%) and increased distressed debt opportunities (33%).

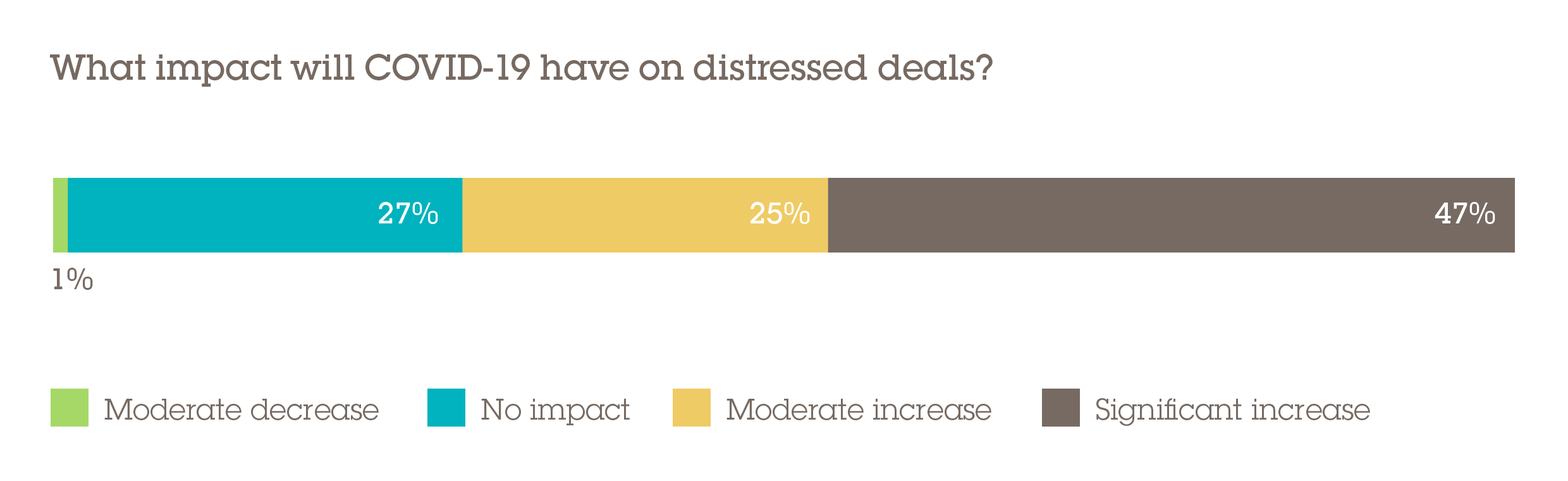

Pricing had been stubbornly high prior to the pandemic, and some assets are even further out of reach, with technology companies in particular surging in value in 2020. But broadly there are now more opportunities to acquire companies at more agreeable prices than was the case 12-24 months ago. As far as distress is concerned, 72% of respondents believe the pandemic will lead to an increase in distressed deals such as loan-to-owns, with 47% expecting that increase will be significant.

To date, little distressed deal flow has materialised. That could soon change once fiscal stimulus and other accommodative measures expire, with many businesses likely to be forced to seek financial support if they can no longer service their liabilities and require restructuring.

“There's going to be a lot of distressed debt deals but more likely towards the year end and beginning of 2022, simply because of moratoriums on loan repayments and everything that governments have done to prop up their economies,” says Claudia Chiper, a partner in Wolf Theiss's Bucharest office. “There is a place for PE to come in and take over companies which are in a lot of distress and are struggling with their debt or have become insolvent.”

COVID challenges

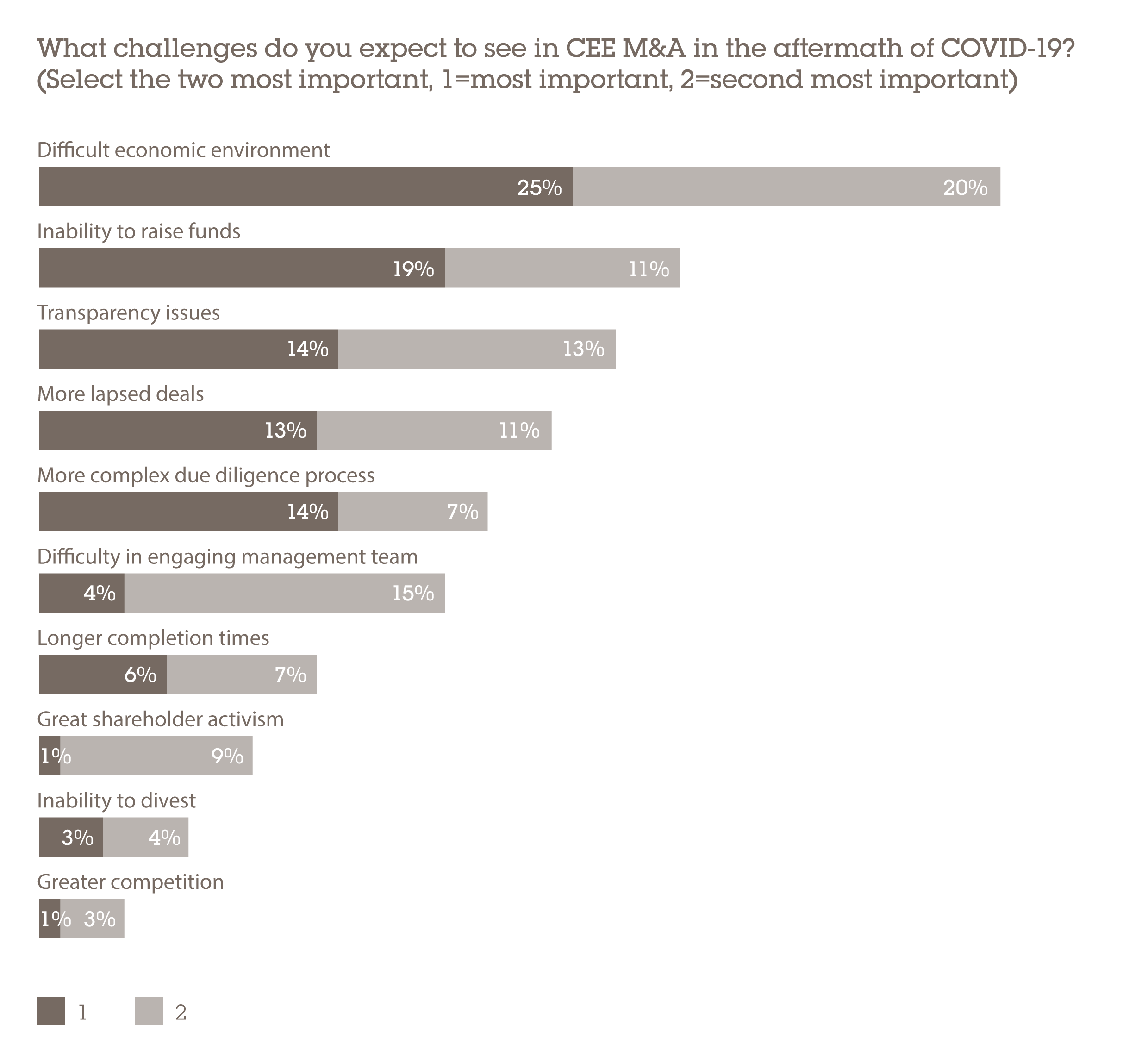

From a downside perspective, the top three challenges over the coming months are seen as a difficult economic environment, cited by 45%, followed by the inability to raise funds (30%) and transparency issues (27%). The latter speaks to the aforementioned complications surrounding fair disclosures in due diligence processes and in sale and purchase agreements.

Forecasts for CEE GDP growth in 2021 range from around 3.5% to 5%. However, not all sectors will perform equally in each country and some parts of economies are likely to remain significantly impaired, if only from the revenues that were lost in 2020. Therefore, investors will still be highly risk-conscious over the coming year, navigating a bifurcated market defined by troubled assets at attractive prices and highly attractive, resilient growth assets that command high entry prices. This will be inherently linked to a divergence in industry performance.

“The attractiveness of companies and the impact of COVID-19 will depend on the sector and the region of operations to a great extent,” says the CFO of an Austrian corporate. “But I think that conditions in general will improve, allowing companies to regroup and improve the feasibility of their operations.”

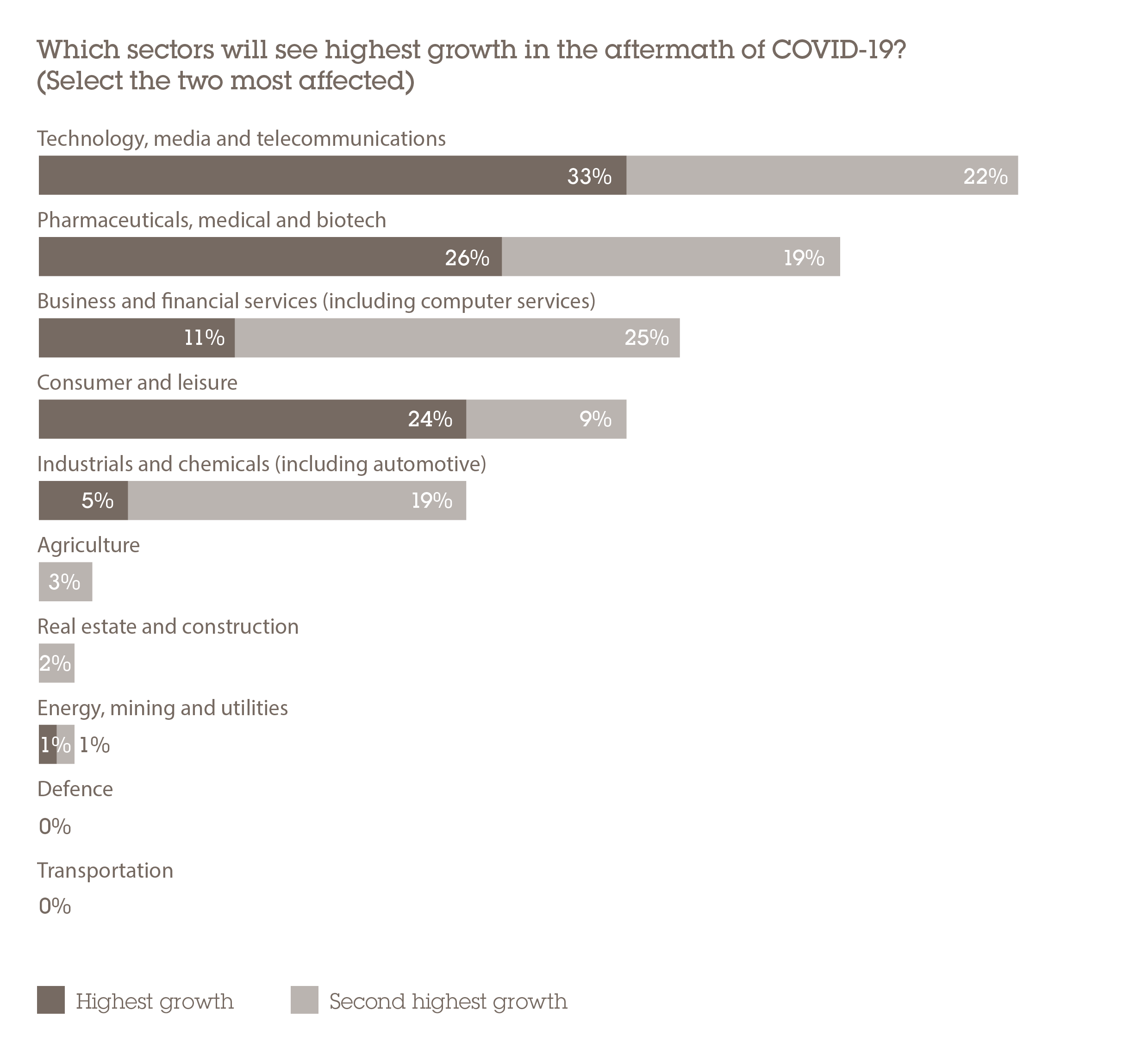

More than half (55%) of respondents say that TMT will be among the top two sectors with the highest growth rate in deal numbers, while pharmaceuticals, medical and biotech (PMB) is in the top two for 45% of respondents. Notably, technology and telecoms companies have been great enablers of economic activity during the months of unprecedented disruption witnessed in recent times, which has made them highly desirable. Media is also highly attractive given the consumer demand for content streaming services amid lockdowns. PMB is a defensive sector during general recessions, and especially so given that the current economic crisis was brought on by a global health emergency.

At the same time, the energy, mining and utilities (EMU) sector has been severely buffeted by the sharp drop in the price of crude oil in early 2020, the second such major decline in only two years. Our research shows that 58% of investors across CEE see the EMU industry as being among the two sectors in which deal flow will be the most negatively impacted by the pandemic, and 36% include the industrials and chemicals sector. As upstream industries, both are highly sensitive to economic weakness. This cyclicality presents its own opportunities for private equity and those willing to pursue deals at the riskier end of the spectrum.

“Energy, mining and utilities, and defence are not performing well currently. They are not generating enough revenue to remain sustainable,” says the strategy director of a Japanese corporate investing in the region. “But this means that distressed deals will increase over the next few months.”

Over the next year, corporate carve-outs will be an important source of deal flow. Recent events have forced companies to review what is absolutely essential to their business and retrain their focus on core markets. However, given the stage of development of the region's economies this activity will stem from international groups rather than CEE corporates.

“There are fewer divestments in the Eastern European region compared to Western Europe, partly because of the age of these businesses. Generally, the region is still relatively early on the growth curve,” says Richard Clegg, a partner in Wolf Theiss's Sofia office. “Many businesses led by first-generation founders are now strong in their home markets and they are actually taking advantage of this situation to expand into new markets. Over the last five or six years we've seen quite a few CEE companies looking for targets into Western Europe and, because of this dynamic, divestments in CEE tend to emanate from multinationals.”