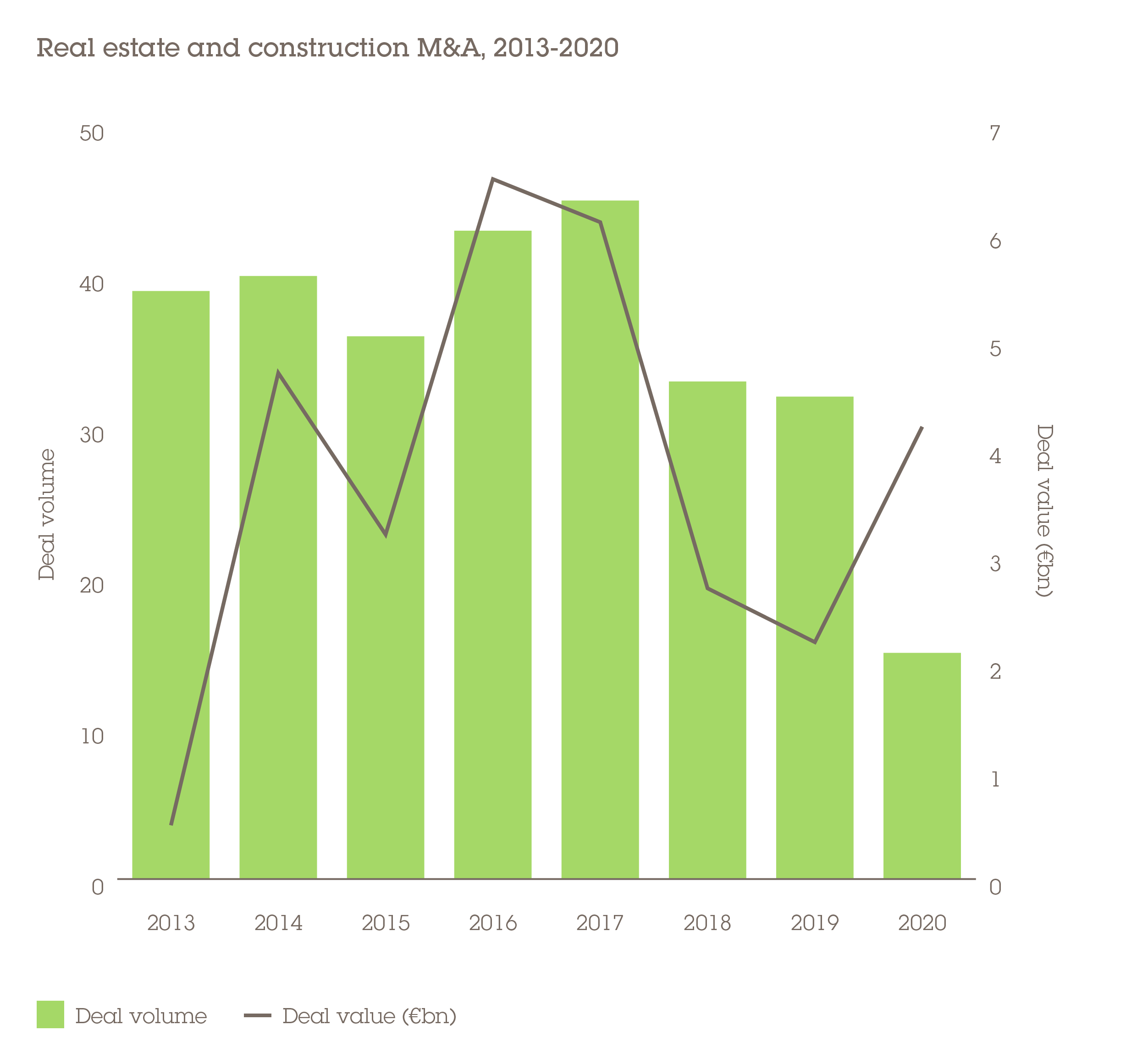

Real estate and construction deal volume decreased by 53% year on year in 2020, a considerably larger fall than the wider M&A market, which was down by 22%. This underperformance is to be expected given the mass exodus from office space to homeworking and the extended closure of non-essential retail stores in 2020. With many businesses postponing their plans for expansion, investors have backed off from the sector.

However, deal value increased 93% over the same period to record €4.2bn, but this came on the back of a weak 2019 and was largely concentrated in just three deals. All three also have at least some exposure to defensive real estate segments.

The largest saw Hungarian sponsor Optima Investment acquire Poland's Global Trade Centre (GTC) for €1.4bn. The company is engaged in both office and commercial space rental as well as residential development for sale. In second place, Sweden's Heimstaden Bostad acquired Residomo, the largest privately held residential portfolio in the Czech Republic, for €1.3bn. Since people still need homes, demand for housing stock is far more robust than demand for commercial property.

The one exception is in logistics and warehousing, which still offer a compelling opportunity. While physical stores have seen their footfall decline dramatically, e-commerce has exploded in the pandemic economy, which is why Poland's Allegro was able to float on the Warsaw Stock Exchange in October in Europe's largest IPO of the year. Regardless of whether people are visiting stores, physical goods need to be transported, stored and sold. With that in mind, Singaporean investment manager GLP purchased Goodman Group's Central and Eastern Europe logistics real estate portfolio for €1bn, in CEE/SEE's third-largest M&A deal in the sector.

All told, these top three deals accounted for 88% of real estate and construction M&A in 2020 and they were front-loaded in the first months of the year, before the full magnitude of the pandemic had been acknowledged.

Deal drivers and destinations

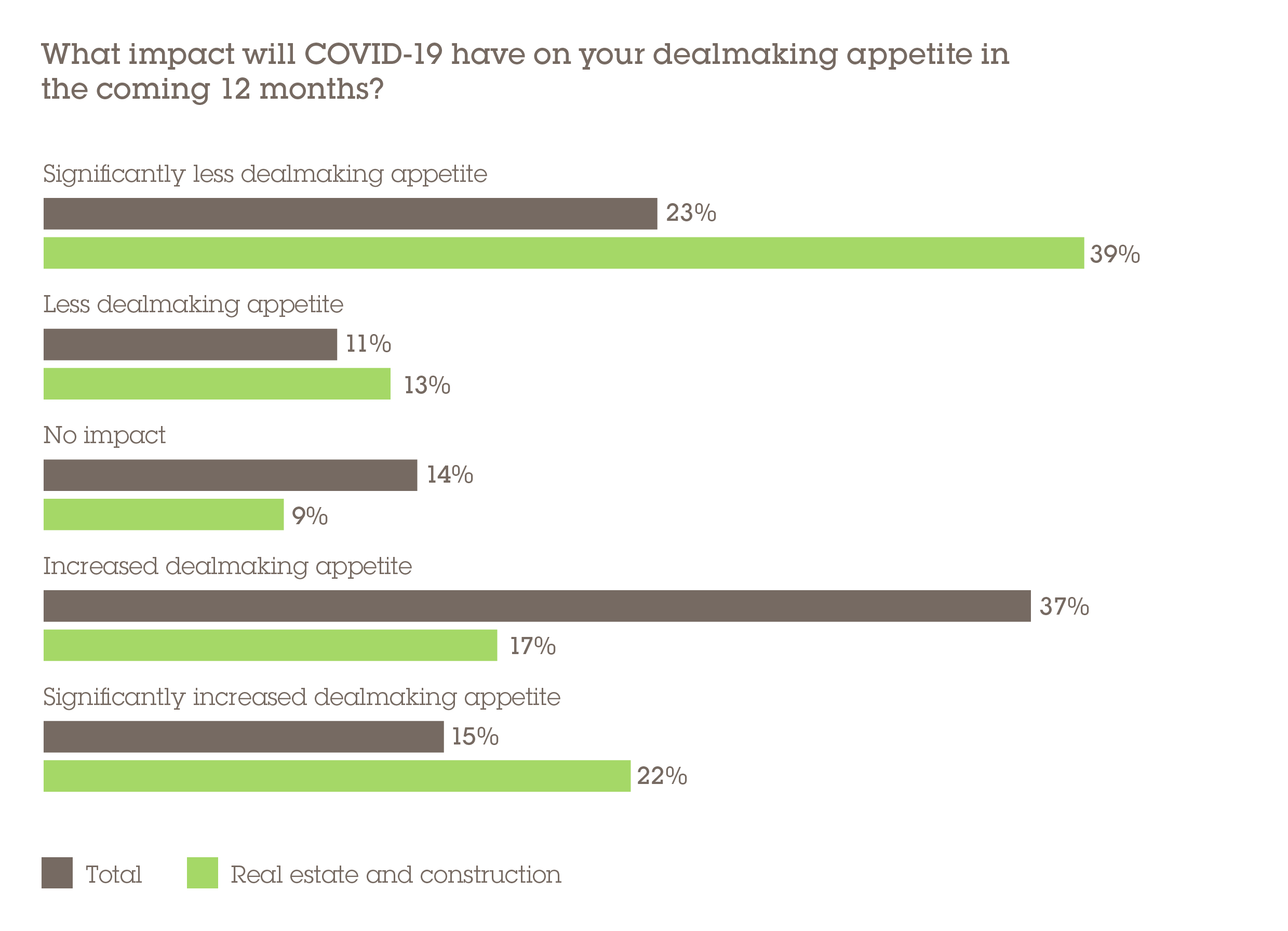

There is polarisation in expectations of future deal flow. Respondents have extreme views of forthcoming M&A activity in the sector, both optimistic and pessimistic. For instance, 22% see a significant increase in deals over the next 12 months compared with 15% who share this optimism across all sectors; 39% see a significant decrease in deal activity versus 23% across sectors. There is logic for the market to go either way, and this will largely depend on the success of COVID vaccine roll-outs and the timeline of the post-pandemic recovery.

A major factor currently working against deal flow is a lack of senior financing available for real estate deals. Banks are significantly more risk averse than they were 12 months ago, and with so few deals in the market it is almost impossible for lenders to determine the fair value of assets. This makes it challenging for banks to underwrite loans as they cannot accurately estimate the value of their collateral. Mezzanine and passive equity funds are stepping in to fill the breach, but with rates of 12-15% on their loans, investors are having to price this into their cost of capital.

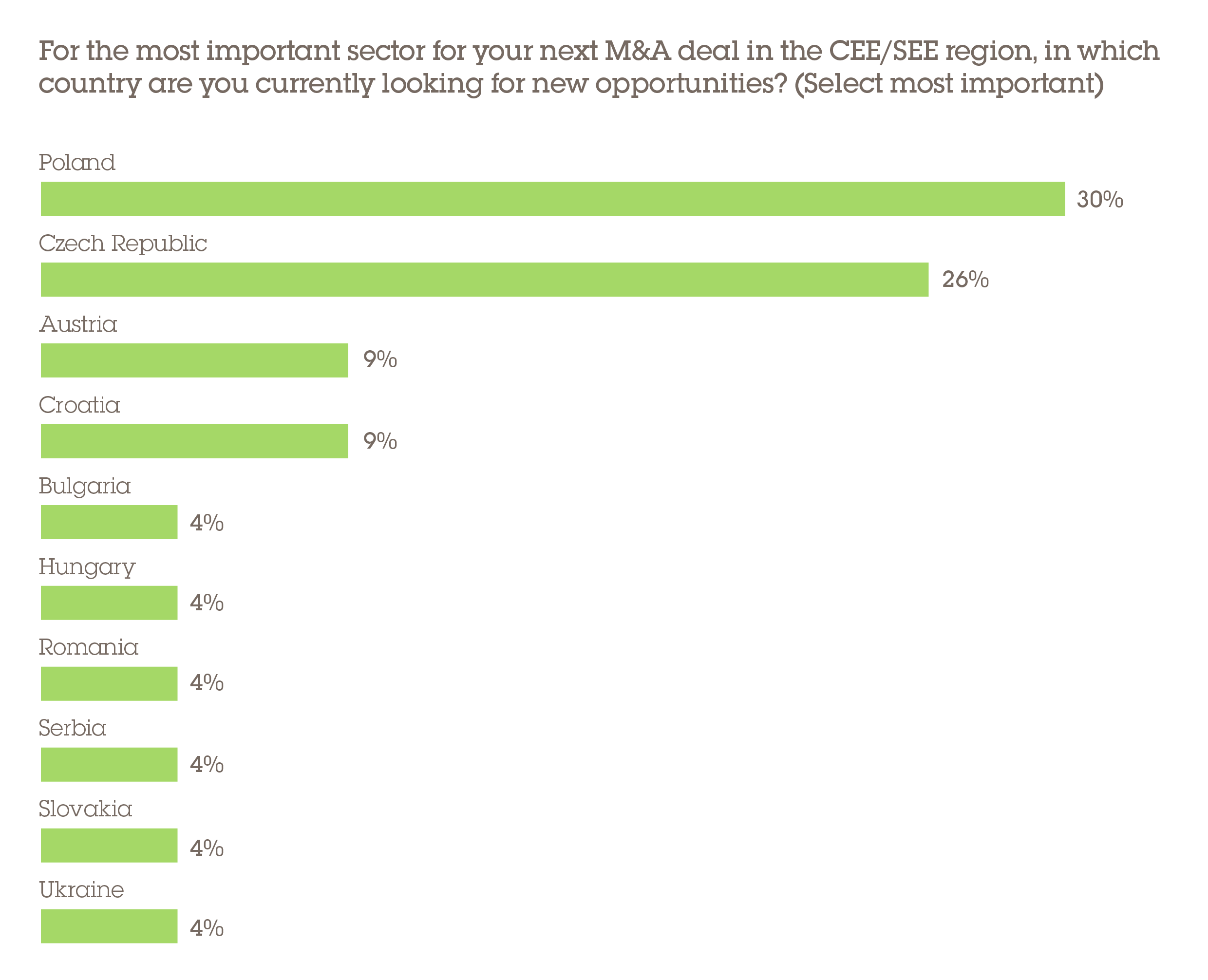

If the market does pickup, then Poland, the Czech Republic and Romania stand out as the key markets for the sector. Thirty percent of respondents have Poland as the country in which they will pursue their next real estate and construction deal, followed by 26% for the Czech Republic with notable interest also in Romania. That these markets are a priority should come as no surprise. They have the largest populations and economies of any EU member states in CEE/SEE, so there is no shortage of real estate stock in which to invest in these countries – Poland being a clear leader in this regard.

ESG on the rise

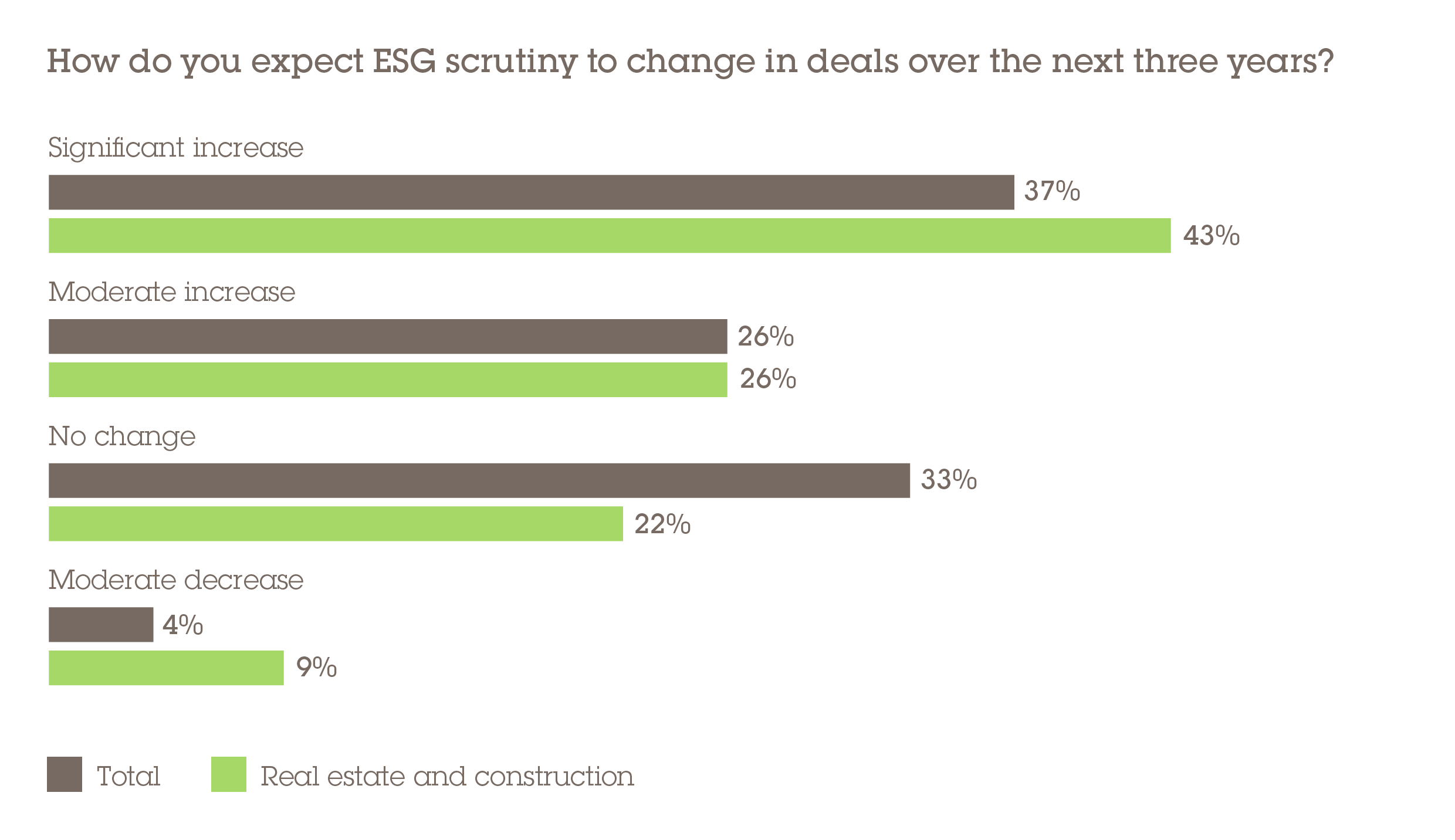

When it comes to picking out particular targets, our survey reveals that ESG considerations are going to become even more relevant for buyers in the future – 43% of respondents believe there will be significantly more scrutiny paid to deals over the next three years. The EU's aims of becoming 'climate neutral' will lead to a tightening of energy efficiency regulations. As businesses continue to promote sound environmental governance, they will look to occupy buildings that meet high standards. This will mean investors will seek out high-quality, green-certified real estate stock to meet this demand.

Future deals depend on vaccine

It is no coincidence that the biggest deals of 2020 within the sector occurred in the earlier months of the year, investors retreating when the pandemic gained momentum.

Commercial retail real estate has been particularly exposed to the economic effects of the ongoing health crisis. While it is likely that M&A will stage a recovery, this is only liable to appear towards the end of 2021 when greater clarity over the roll-out of the COVID vaccine could offer some light at the end of the tunnel for the sector. For the time being, investors are taking a wait-and-see approach. Any deals that do go ahead will likely be concentrated within the comparatively lower-risk residential and logistics segments.