Far from easing regulatory oversight in light of the challenges facing businesses, in accordance with EU guidance many CEE authorities have stepped up their screening of deals with the passing of new legislation.

Hungary, the Czech Republic, Poland, Austria and Slovenia have all introduced recent foreign direct investment (FDI) vetting mechanisms, either with new laws or amendments to existing ones. The purpose of these measures is to protect valuable assets from takeovers by non-European entities, although in the case of Slovenia even foreign investment by EU businesses is now being vetted. Broadly speaking, this is achieved by broadening the scope of strategically sensitive sectors and considerably lowering thresholds for FDI that requires approval.

“What makes it hard is that when you buy a company in the UK and it has subsidiaries in Hungary, Romania, Austria, and Poland, you may require approvals nationally in all those countries, which is a bit like traditional competition law in terms of the hurdles it creates as deals have to pass through these bureaus across Europe,” says Anca Jurcovan, a partner in Wolf Theiss' Bucharest office.

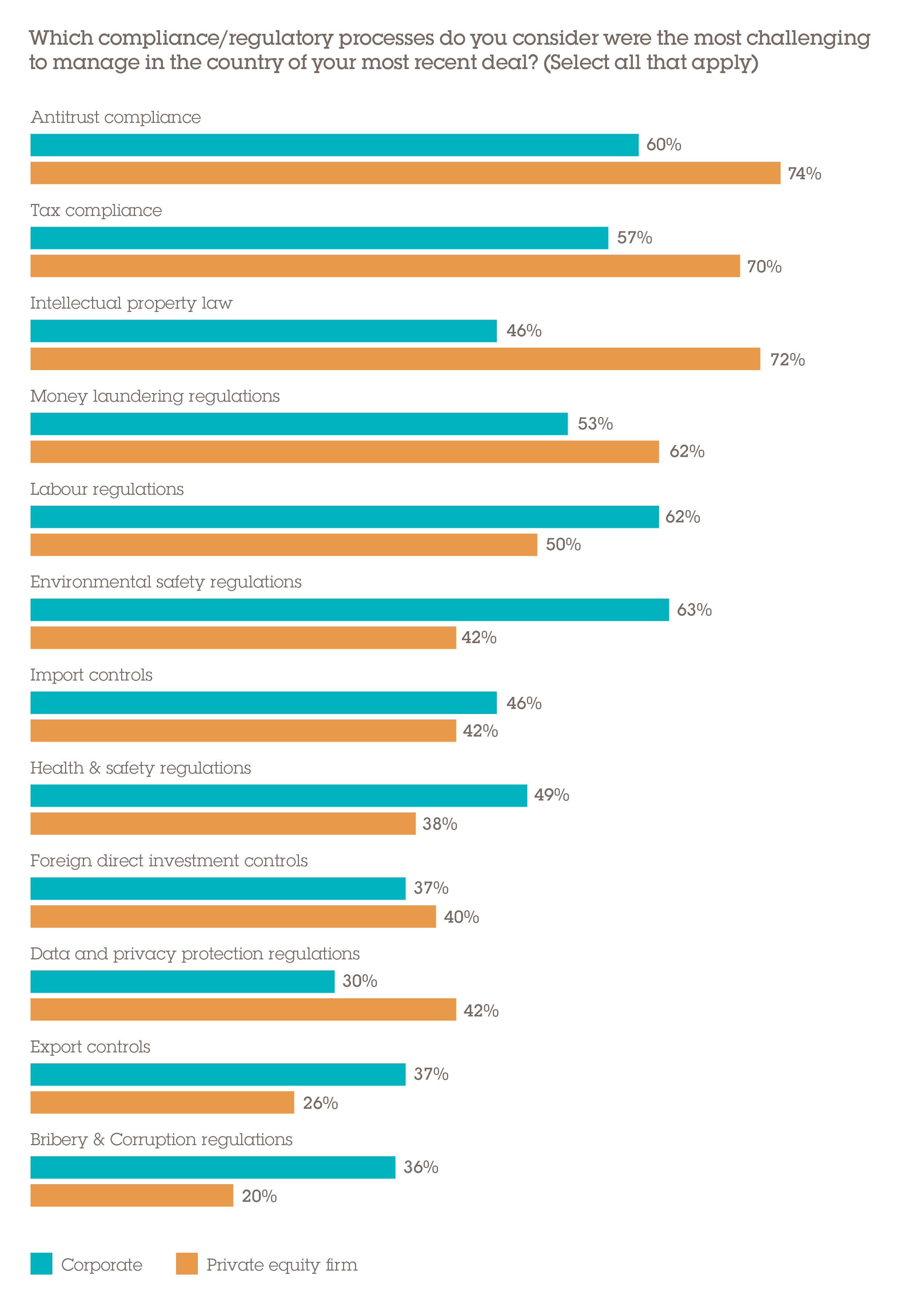

For the most part, respondents are not concerned by these developments – only 37% of corporates and 40% of PE firms said that FDI controls were the most challenging regulatory process to manage in the country of their most recent deal. This likely reflects two things: one, how recently these laws were updated and, two, the fact that 74% of our cohort are based in Europe and so in most cases are not investing from outside the EU.

Antitrust out in front

The most common regulatory challenge, cited by 65% of respondents, is antitrust compliance, closely followed by tax compliance, cited by 61%.

“Antitrust compliance is difficult because there was a lot of ambiguity surrounding the purpose of this regulatory practice,” says the head of investment of a Canadian corporate. “Growth opportunities face significant barriers because of this.”

One of the challenges of securing deals can be the time it takes for sign-off. Bloated public administrative bodies can inhibit business formation and M&A owing to the timing and complexity of approvals. A case in point, in July 2020, the Administrative Court of Sofia repealed a decision of the Commission for the Protection of Competition (CPC) by which the Bulgarian competition regulator prohibited the sale of Czech energy group CEZ's Bulgarian assets to Eurohold. Following the Supreme Court's decision, in August 2020 the CPC reopened its review and cleared the deal. That deal had been initiated back in June 2019.

“The processes of evaluation and approvals in our last deal were drawn out,” says the managing director of a Bulgarian PE firm. “There were many times when the timelines of completion were very uncertain. This put the whole deal in jeopardy.”

There are some notable differences between private equity and corporates in their perception of the biggest legal and regulatory hurdles they have faced in CEE. For instance, 72% of PEs found IP law challenging compared with only 46% of strategic buyers. Meanwhile, 36% of corporates found bribery and corruption challenging compared with only 20% of PEs.

Data and privacy regulations were not one of the most widely cited challenges, with 34% of investors flagging this issue – 30% of corporates and 42% of private equity firms. This is despite the EU bringing in the General Data Protection Regulation, which came into force in May 2018 with hefty fines for non-compliance. While the law applies to personal data specifically, it has caused complications for multiple respondents, especially at the deal review stage.

“Data and privacy controls are difficult to manage, because they make sharing of information challenging,” says the head of M&A at a Swiss corporate. “It was difficult to assess the paperwork and any previous incidences of data breach at the target.”

This same point was shared by the managing director of a UK PE firm who said: “We had to hire an external consultant to help us with the process, because the data and privacy laws were very restrictive. It hindered the progress of the due diligence teams.”

Mitigating risk

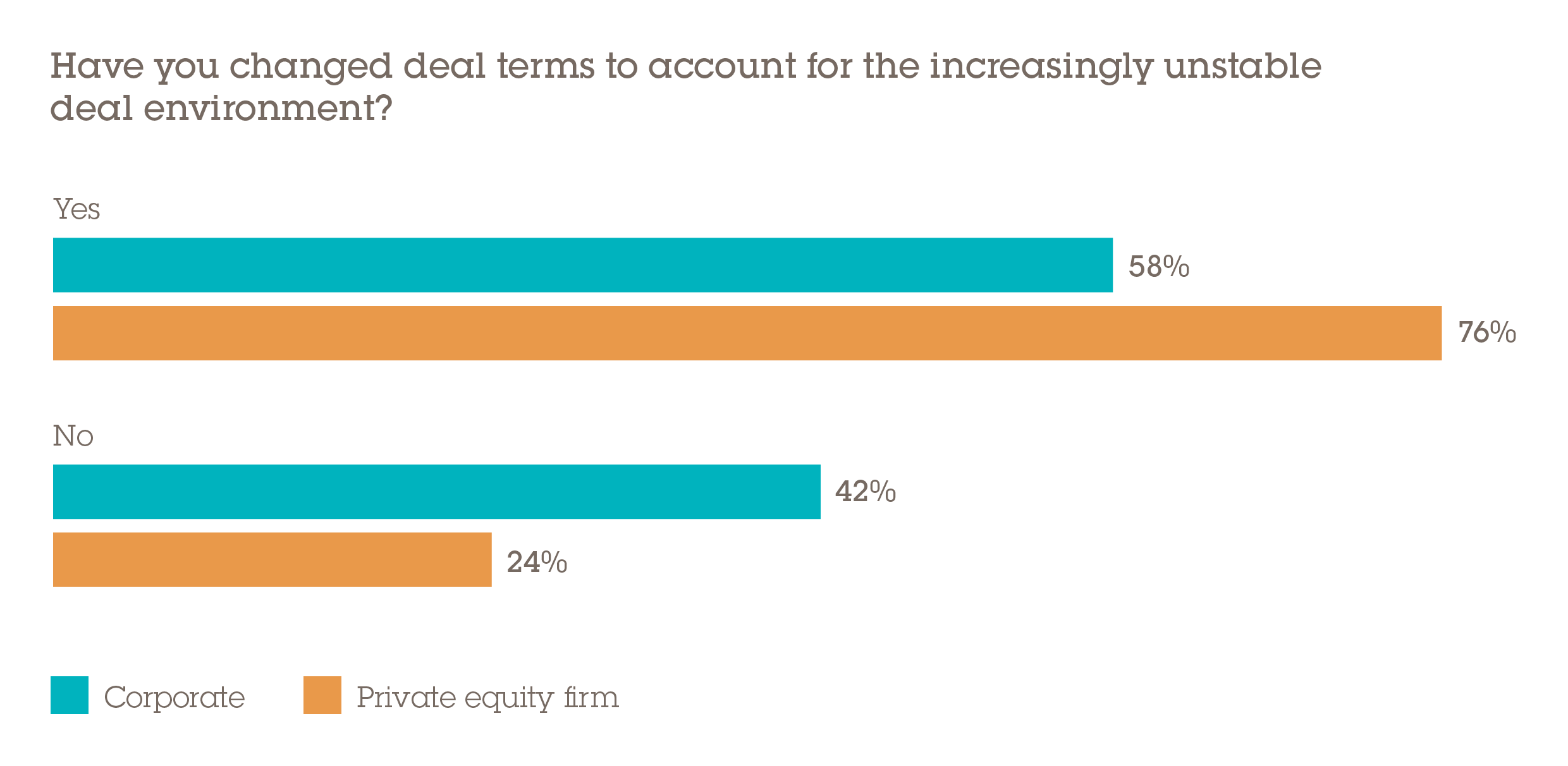

Nearly two-thirds (64%) of respondents have changed deal terms due to the unstable environment, including 76% of PE firms and 58% of corporates. We posited that this split may be explained by private equity's price sensitivity – pricing being a fundamental deal term that may need to be negotiated in light of ongoing uncertainty.

There are many other mechanisms by which investors can contractually protect their downside. Material adverse change (MAC) clauses have been an obvious point of contention in the past 12 months. MAC clauses assign systemic risks to the buyer by determining that certain events which may negatively impact the business are outside of the seller's control. Any adverse change in the business that is within the seller's control can therefore allow the buyer to terminate the transaction. While the language of MAC clauses is typically vague and they can be hard to enforce without litigation, since the pandemic there is an effort to ensure that sellers are not accountable for any changes to the target company caused by the pandemic.

This is where the desire among buyers for COVID-related representations and warranties to be included in sale and purchase agreements (SPAs) comes in. Buyers may require sellers to represent and warrant that there have been no government orders which have inhibited the target's operations or its key customers and suppliers. Acquirers may also seek binding confirmation that the company has not fallen foul of COVID-related laws and regulations. The terms of COVID-related representations and warranties and MAC clauses are up for negotiation and investors are paying close attention to these contractual details.

The terms of warranties and indemnities, insurance policies are another point of focus, as insurers seek to narrow the scope of their coverage by excluding provisions that relate to the ongoing pandemic. This is especially relevant as nearly three-quarters (72%) of respondents say they now place a greater reliance on warranties and indemnity insurance since the onset of the pandemic. “We have used insurance to protect against the sudden shift in the investment climate,” says the CFO of a Polish corporate. “The past year has been very unexpected, and the health crisis is really affecting the practicality of due diligence processes.”

Our research provides further insight into what contractual tools investors are using to mitigate risk, with 44% reporting to have used break fees and 42% having used earn-outs to protect their downside. Given the high unpredictability of the current situation, expect such clauses to become an even more common feature of SPAs.