Deal opportunities in CEE/SEE will be plentiful, both in the near term amid the post-COVID-19 recovery and over a longer-time horizon. The fundamentals that attract investors – high growth, manufacturing and technical expertise and relatively low labour costs – remain in place and there is now a critical mass of deal targets as first-generation founders weigh their exit options.

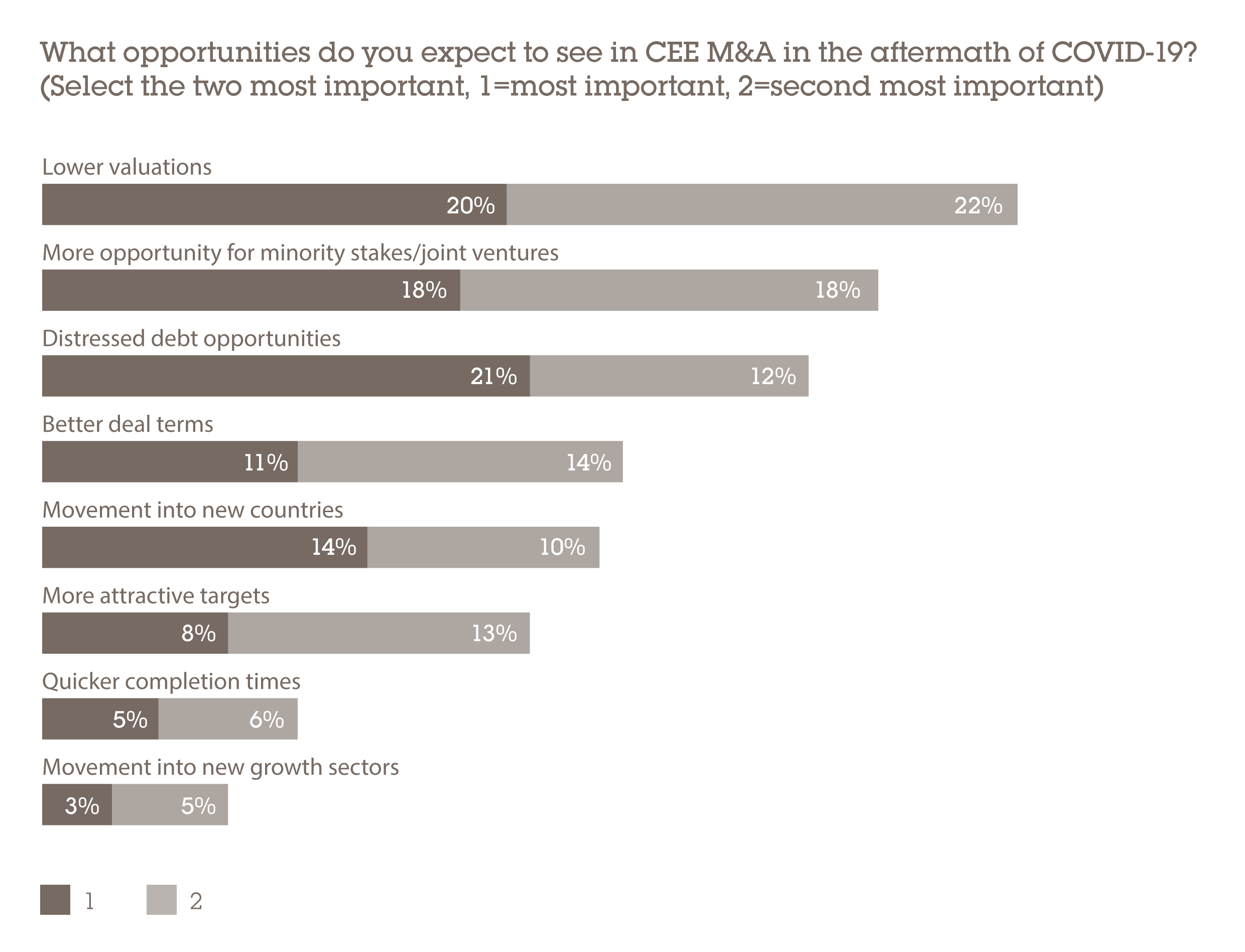

Over the coming months, investors have their eyes on the same opportunities that follow any period of massive economic disruption, namely attractive pricing and distress. More than one in five (21%) respondents say that distressed debt deals are the single most compelling opportunity in the region in the aftermath of COVID-19, with 33% putting it as one of their top two opportunities.

A number of Western European banks have expanded their activity in CEE over the past decade, including the largest, Unicredit, which took a decisively corporate-centric approach, homing in on syndicated loan activity rather than consumer lending. There should be no shortage of opportunities to acquire non-performing loan books and restructure the debts of single assets over the next 24 months as lenders tend to their portfolios and as the momentum provided by stimulus fades.

Pricing is also expected to be a short-term driver: 20% of respondents singled out lower valuations and 42% have this in their top two opportunities. One view is that strategic buyers will be more judicious in their M&A activity until there is greater stability, creating an opening for PE to capitalise upon.

“Corporates have adopted more conservative dealmaking practices recently and this means there will be less competition for assets and therefore sellers will be willing to accept lower valuations,” says the managing director of a US private equity firm.

The unique draw of the region

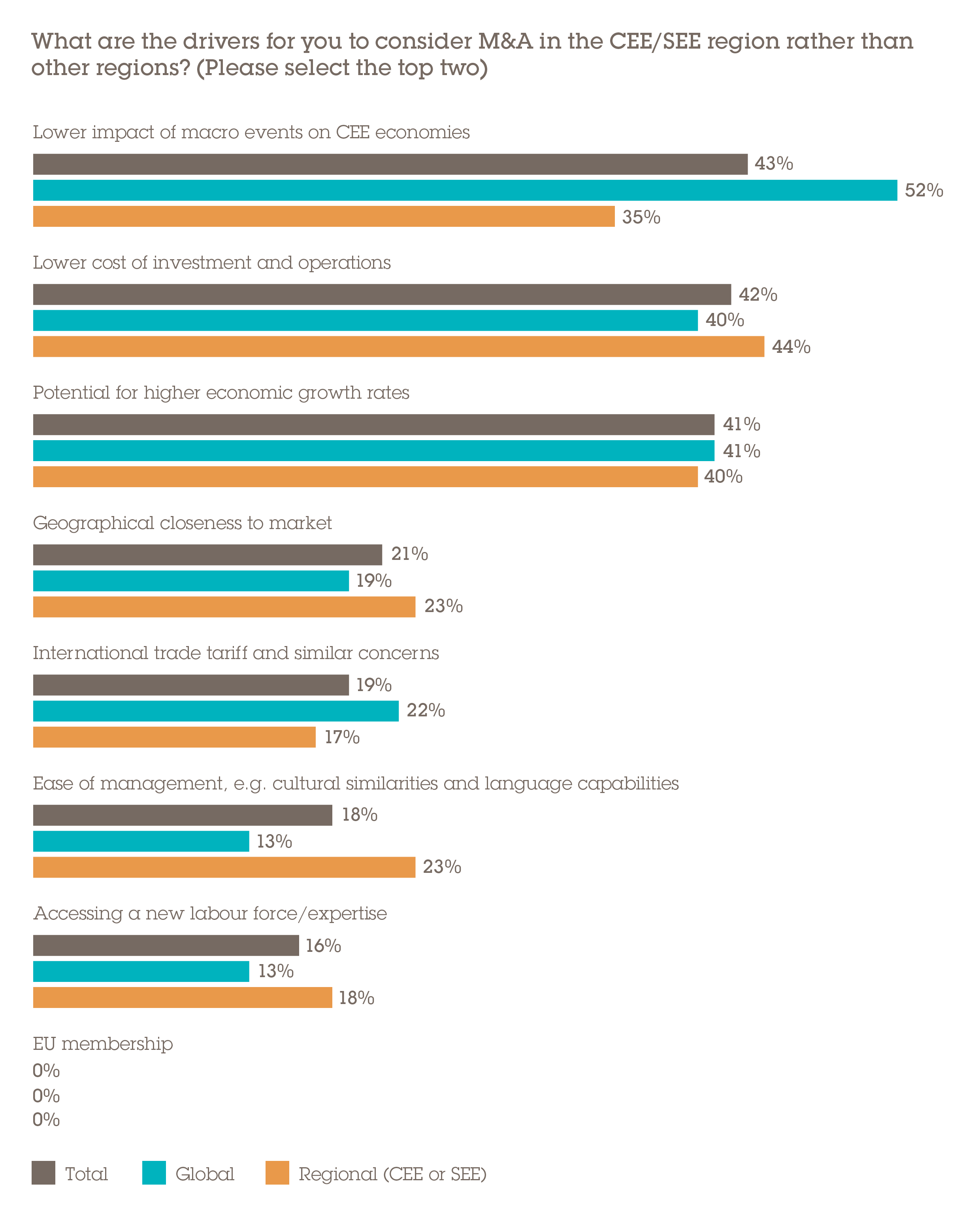

Lower valuations and higher rates of distress could be said of most regions in 2021, but CEE/SEE possesses a number of characteristics that makes it unique. For respondents, the motivations to invest in the region over others are the lower impact of macro events on CEE economies; lower cost of investment and operations; and the potential for higher economic growth rates, cited by 43%, 42% and 41% respectively.

Certainly the strength of underlying growth is evident, especially in countries such as Poland, which at -3.3% saw one of the smallest GDP contractions of any country in 2020. This also marks the first recessionary year for Poland in decades – not even the global financial crisis halting its growth. While estimates on Europe's economic performance vary, Berlin-based Scope Ratings has the euro area shrinking by 8.9% in 2020 and CEE's GDP down by just 5.3%, illustrating the resilience of the region.

Labour costs also remain at competitive levels in spite of their increase as the region converges with Western Europe. Indeed, CEE is benefitting from China's own rising costs and protectionism. High trade tariffs and closer regulatory scrutiny of Chinese investment is redirecting US and European capital away from Asia's largest economy to the likes of Poland and Romania.

“Labour costs have risen significantly in China over the past five years or so and a lot of production that was relocated to the Far East a long time ago is being re-shored because of these costs, supply chain issues and increasing regulatory restrictions, embargoes and sanctions,” says Ileana Glodeanu, partner in Wolf Theiss' Bucharest office. “Big groups have come back to the notion of having their manufacturing either in the EU or close to the EU in order to be more resilient in the long term. That's a very strong driver for the region and is an underlying theme for the EU right now that has policy support.”

Hitting the target

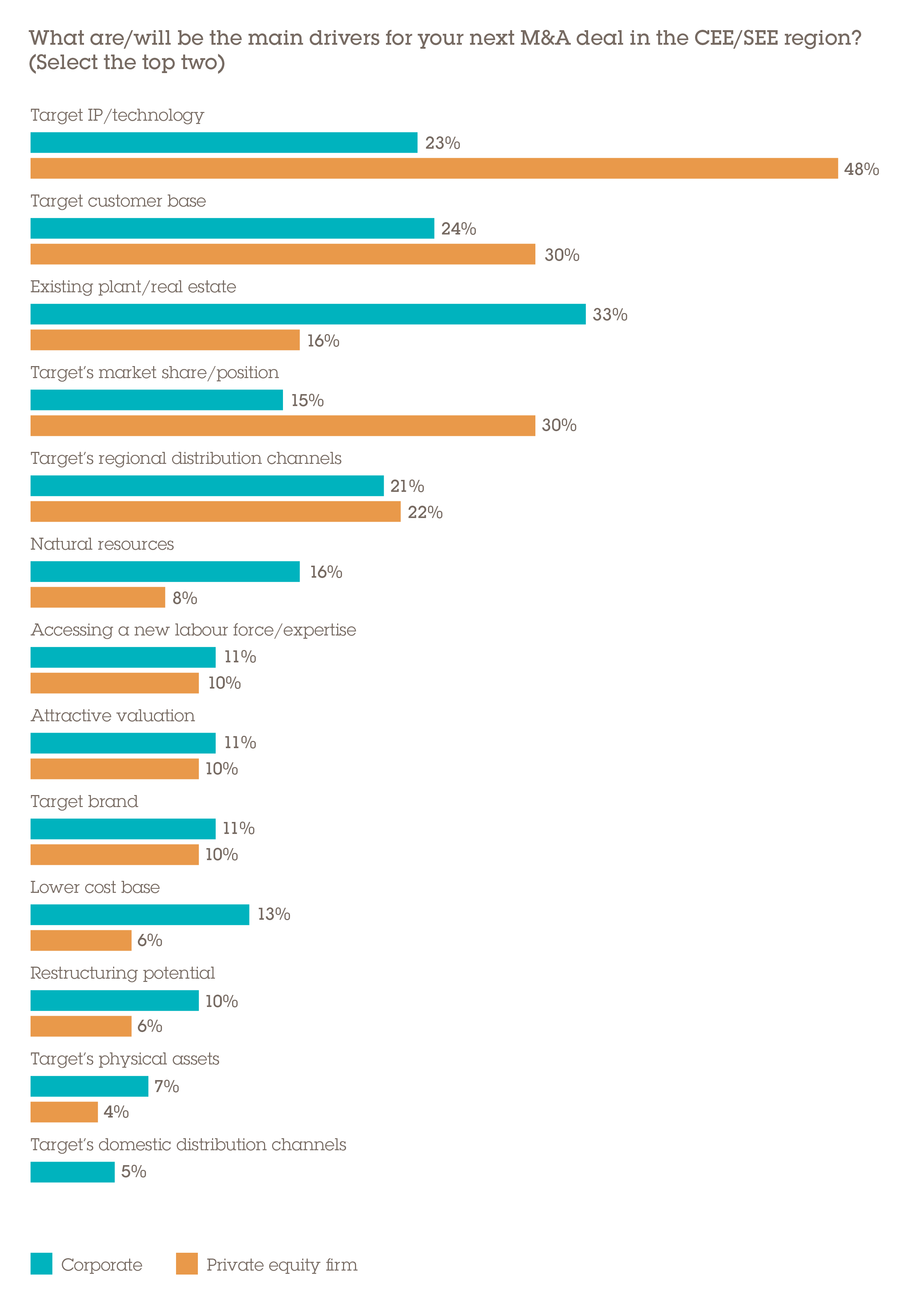

Intellectual property (IP) including technology is expected to play a major role in dealmaking in CEE/SEE, with 31% of respondents having IP in their sights as the chief driver for their next deal. There is a notable split between PE and corporates here. Nearly half (48%) of fund managers are searching for compelling IP compared with only 23% of strategic buyers who said the same. We explore further splits between PE and corporate deal motivations here.

For comparison, a target's existing plant/real estate is far more of an attraction for corporates than PE: 33% have this as a main deal driver versus just 16% of private equity respondents (27% across respondent types). This speaks to the unique strategic fit of existing physical assets that a deal may present and the potential for synergistic cost savings that strategics can make. Private equity does not benefit from these synergistic effects when making original platform deals, only bolt-on acquisitions.

The third most important deal driver, cited by 26% of respondents and with little difference between corporates and PE, is the target's customer base. Consolidating a competitor's customers represents a relatively straightforward value-creation opportunity and can also free up a company's bandwidth to grow by other means instead of being preoccupied with organic sales growth. This is particularly relevant during this period, in which revenues are under pressure and a high degree of uncertainty persists.

“If the target has a good customer base, we will not have to invest as much in marketing and sales strategies,” says the director of corporate development of a US corporate. “With that inorganic growth achieved through M&A we can then think about further technology developments to improve the quality of services.”

Location locator

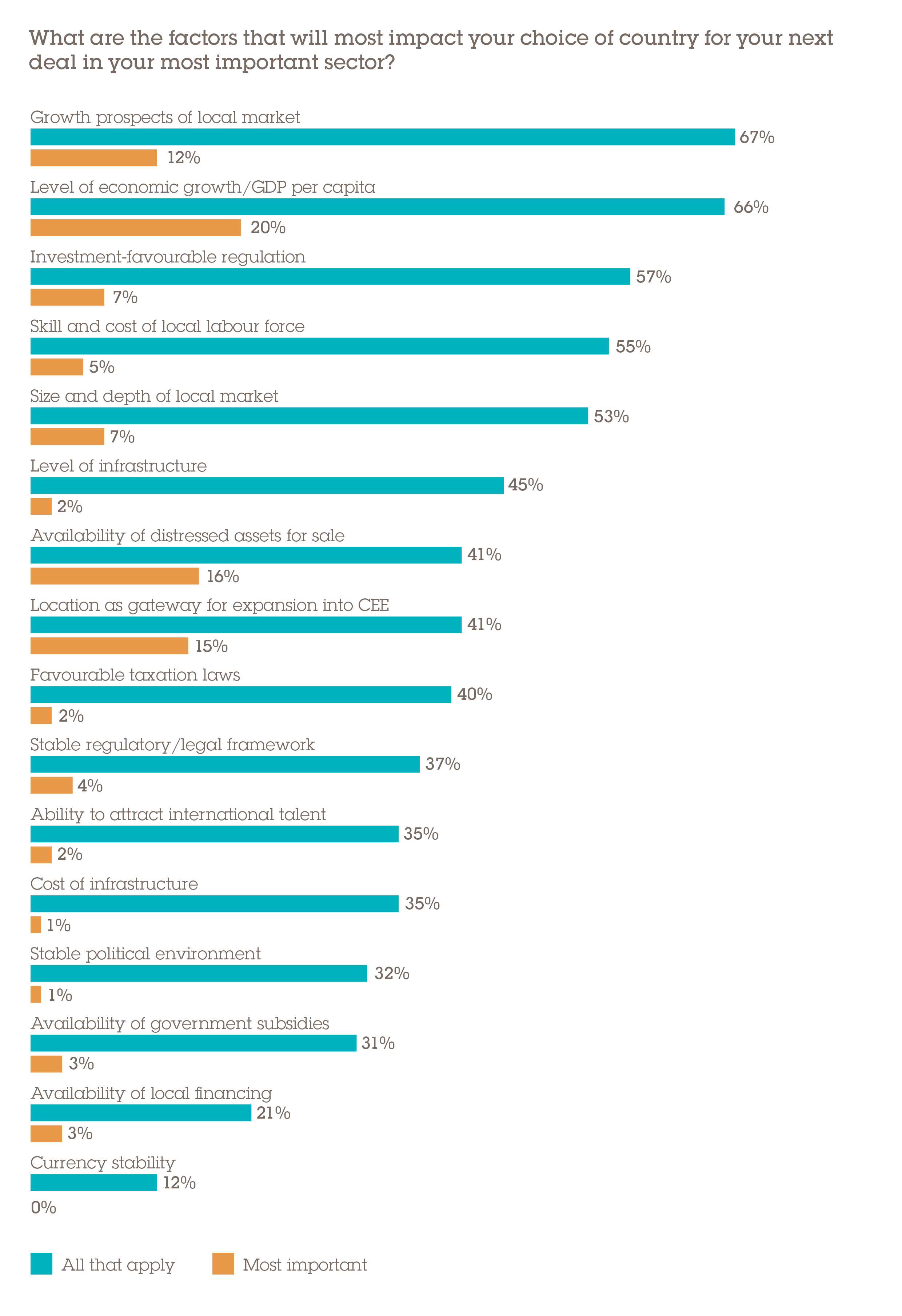

Selecting a country in which to invest, meanwhile, is primarily motivated by economic fundamentals. For instance, growth prospects of the local market and GDP per capita were cited by 67% and 66% of respondents as among the factors that will most influence which CEE country to invest in. This would favour Poland, the largest and strongest-performing economy in the region, and Austria, which has the highest GDP per capita.

With regard to the single most important determinant of country selection, the findings are more nuanced. GDP per capita came out on top with 20% of the vote, the availability of distressed assets (16%) and the country being a gateway into the region (15%) also being strong deciding factors.